- MoneyBits

- Posts

- 3 pence per mile

3 pence per mile

...driven to taxation

📚️ PDF⏳️ 7 min 📖 6

UK Budget

I’ll tax them on their dog

Tax them on their cat

I’ll tax the man, and his wife

On this and that

I’ll tax them when they fly

I’ll tax them when they die

Some extra pennies, you know

When their loved ones die

I’ll tax them when they drive

however hard they strive

3 pence per mile

enough to make us smile

I taxed them in the morning

I taxed them at night

They won’t even notice

It will be alright

Amongst the lowlights were the new road taxes. Three pence per mile for electric cars. I imagine this being deeply unpopular simply because of how it will eat away at people. Driving down the road knowing every extra metre is costing them tax. On average it's about £250/year but that's not really the point. It’s the depressing relentlessness of the government take. The proverbial boot on the throat; very bad politics. It was always true anyway with fuel taxes but they are slightly more obfuscated. Charging per mile seems so raw, such a direct assault on daily life I wonder how it will be received.

There were some new ‘wealth taxes’ too. The Mansion Tax targets homes valued at £2m+ and £5m+, which will now attract annual levies of £2,500 to £7,500. It’s another bizarre tactic to chase rich people away in a country where 50% of the tax revenue already comes from only 1% of the people.

I had a quick look on RightMove to see what kind of mansion you get in London these days for £2m. This place in Southfields, South West London looks fit for a King. Not sure the real estate agent tried that hard, not bothering to cut the grass or shoo the staffie out of the foreground. Here’s the link if you want to throw in a bid.

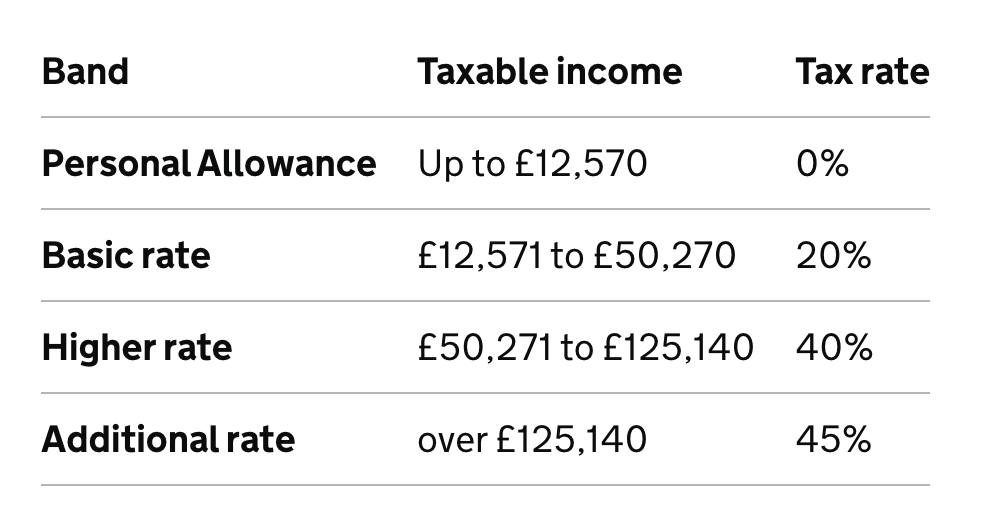

Most iious of all though the continued freezing of the income tax bands. In 2021, during Covid, the bands were frozen. The government of the moment said “everyone must play their part”, in what were difficult times.

By the time the following year rolled around the freeze was extended until 2028. On Thursday this was extended to 2031, a full decade of zero-indexation. This is exactly how financial repression works. It is very clever really because the government can legitimately claim “no change”.

The extent of the punishment is modelled here. This assumes a pay rise each year of 3% and a true inflation rate of 5% (which is me being generous). The purchasing power over the decade drops by 20%.

This is not an exaggerated ‘look at what might happen’ scenario. It's a fairly generous appraisal of the situation.

The band freeze is now the single biggest tax rise in the history of the United Kingdom. Even more amazing, neither the party that introduced it, nor the one that extended it had it in their manifesto. Nobody voted for it and nobody got the chance.

Overall, it was a terrible day for everyone in the UK. The bond market barely blinked though suggesting that just the right amount of financial punishment has been meted out to keep the show on the road a little longer.

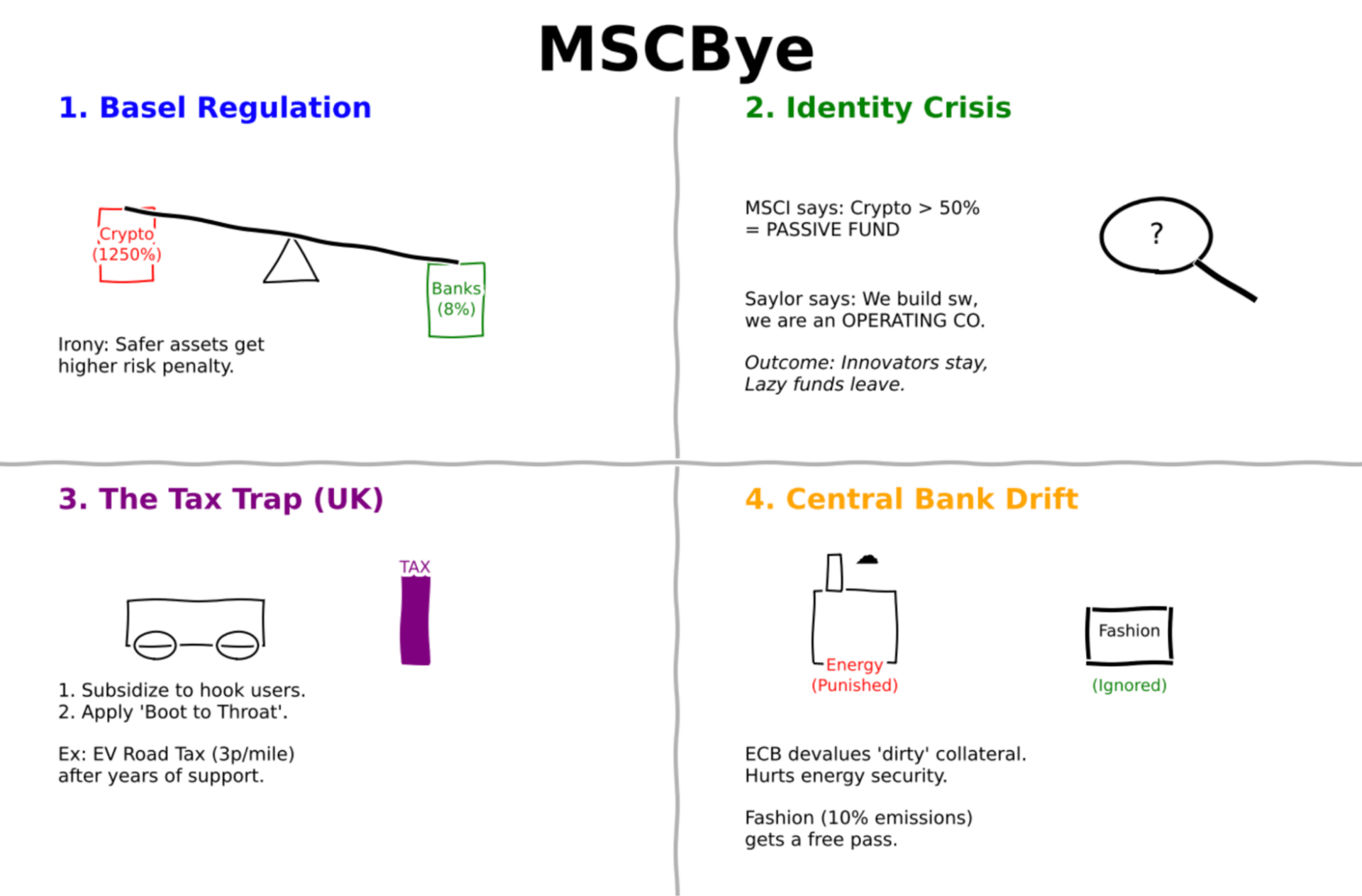

1250%

1250% risk weighting seems a bit excessive, no?

Indeed it is rather revealing about the general fragility of banking. At present the Basel rules require (amongst many other things) that if a bank makes a $100 loan, $8 of that loan needs to be with its own money. $92 of it can be borrowed. Before we get into the addition of crypto assets, we should just remember that. The minimum requirement for banks is to be 8% backed with their own money. Hardly robust stuff, as Credit Suisse shareholders discovered.

If a bank adds $1 of stablecoin to its balance sheet, the Basel rules say it must add $1 in equity so that it is fully funded. That is the highest weighting of capital requirement for a bank, 1-for-1 backing, only for the very riskiest of assets. From that we can derive an assets risk weighting of 1/0.08 = 1,250%

In essence the rules simply say that the addition of crypto assets cannot alter the risk profile of the bank.

I have no doubt that for lots of assets in the sector it is a sensible choice, but for stablecoins it’s over the top and then some. For example, if our bank adds $1 of Tether, that Tether itself is already 100% backed by a US Treasury bill. Why then does it need to be additionally backed by $1 of the bank's capital. $1 of Tether is far safer than $1 in a counterparty bank account, which also enjoys only the 8% backing.

The Basel risk weighting for deposits at other banks is about 20%. So for $100 the bank is required to hold $100 0.08 0.2. $1.60.

The implication is that a 100% backed stablecoin is 62.5x more risky than an 8% backed bank deposit. It cannot possibly be correct and it's hardly surprising that the US and the UK have said so.

It rather gives off the whiff that the rules are designed to protect the incumbent operators cartel rather than to meaningfully do anything for the risk exposure of the end customer.

MSCI

One of the reasons behind the recent sell off is the review of Bitcoin treasury firms by index provider MSCI. They run all manner of funds and indices across global stock markets.

Their contention is that a company that holds more than 50% of its assets as digital assets is more akin to a fund than a company. Perhaps that is right, but plenty of companies hold an awful lot of cash and not much else, and they are included on the basis of their underlying business.

The most exposed firm in the short term would be Strategy (MSTR). Michael Saylor had this to say.

I think his argument is a reasonable one. Decision day on all of this is 15th January, my guess would be that pure treasury play companies that simply list and then buy bitcoin will be excluded from MSCI as quasi-funds. Everything else, including Strategy, will stay.

In the end though what difference does it really make? If someone wants bitcoin, they can buy bitcoin or they can buy the ETF. I’m not actually a fan of treasury companies save for the first mover, Strategy. They now have the scale to design innovative products. The rest of them are…..well they are funds, and in that respect it’s hard to disagree with MSCI.

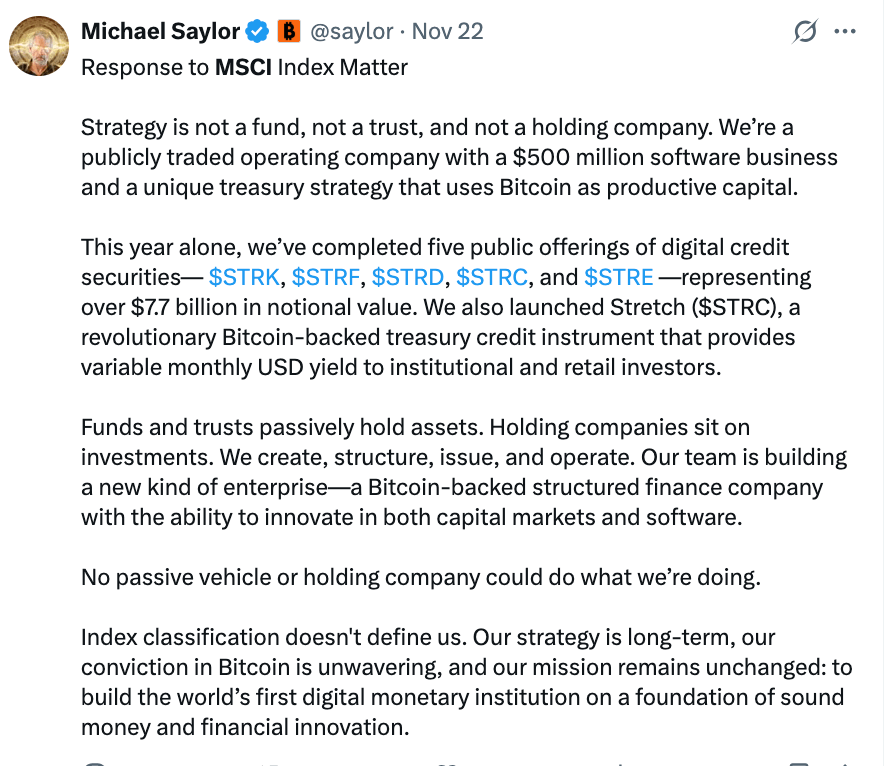

Nano-Banana

If you haven’t had a go with Google’s new Gemini-3 you really should. In particular the new image generator is super impressive. In this case I loaded the PDF of Moneybits (excluding this section) and told it to visualize this week's effort as a whiteboard. This was a single shot effort, one prompt. It completely grasps what each section is about. I would think with a couple more prompts it would be even better.

It’s a depressingly good summary in 10 seconds.

Note this works on entire volumes of text. You could drop your favourite book in and it would do it too.

It is far better than this simple demonstration though. I have found the more complicated the inpt (at least to my mind) the better the output from Nano-Banana. That is particularly true with things that I don’t fully understand. Like computer code or some complicated smart contract, it is outstanding at breaking down the concept and putting it on a white board.

Massively underrated, Google is a mile in front on AI now. The core theme of MoneyBits which is of poking fun at Christine Lagarde is ignored in the bottom quadrant. Encouragingly, it seems if we want to be rude about our leaders we will still have to do it ourselves.

Euro-Trash

It’s been at least a few weeks since Christine won something. I was worried, you were worried, we can now relax. Included in Time Magazine's Climate 100. Expressly for the following reason:

On July 29, Lagarde's ECB announced that starting in the second half of 2026, it will adjust the value of polluting companies differently than clean ones when banks need to borrow money. This was done to protect the Eurosystem against potential declines in the value of the polluting companies in the event of adverse climate-related transition shocks.

Here's how it works: when banks borrow from the Central Bank, they must put up assets as collateral (like a security deposit). Under the new rules, assets from companies that could cause higher climate risk to the central bank will be worth less as collateral. This matters because it could make lending to polluting industries more expensive for banks.

The most impacted sectors are fossil fuels, energy-intensive industries, heavy manufacturing, construction and building materials. We can see now why the big oil companies want to move their bases out of Europe and to the US. Far better in their view to be a US company than a European one.

The ECB has managed to do this within the existing risk rules essentially suggesting that these industries are “most at risk” during the climate transition and therefore their collateral is worth less. Arguably, correct but they are also the industry Europe most needs. They are meant to be building a new war machine, how will they do that without energy and heavy industry?

One thing stands out to me. The fashion industry. How does it escape criticism? How is it that a coal fired power station that powers children's hospitals and heats the homes of the elderly viewed with such cynicism and the $5 t-shirt industry, a far bigger polluter, just waltzes on by?

Fashion comprises 10% of total global carbon emissions, as much as the emissions generated by the European Union itself, and all its energy and heavy industry. The industry depletes water sources and pollutes rivers and streams, while 85% of all textiles go to dumps each year. Even washing clothes releases 500,000 tons of microfibres into the ocean each year, the equivalent of 50 billion plastic bottles.

That is the issue with the ECB approach, it's arbitrary. All industries are downstream of energy and heavy industry anyway. There are massively polluting industries that just get away with it because they haven’t been demonised in the public perception. What’s more, all these policies just push up the cost of living for everyone.

Is this policy really worth lauding Christine Lagarde for? I can’t think of a better example of how a central bank has become so politicised that it can bend its own risk rules to try and derive a political outcome.

They have one job. Keep the price level stable. They haven’t done it, ever. All this is all a distraction from that abject failure.

Further Information

Our October 2025 report to investors can be found here.