- MoneyBits

- Posts

- A letter from the House of Lords

A letter from the House of Lords

...about your VPN

📚️ PDF⏳️ 5 min 📖 6

Player Piano

I have not been helped in this analysis by reading Kurt Vonnegut’s 1952 book, Player Piano. It imagines a future dominated by machines. Paul Krugman, referring to the book, argued earlier this year that new technology shifts jobs rather than destroys them. I’m not so sure. Thinking machines are not the same as machines that make widgets and I would say the book is a better read now that it has been at any time in the last 70 years.

That the S&P 500 and U.S. job openings diverge makes sense. Replacing a $500,000 engineer with a $500 subscription is a huge boost to productivity and profits in most industries, and it is happening.

AI is the new workforce. Those on the leading edge of AI are also, not coincidentally, the ones who use it most, simply because they understand its power the most. Google, for example, 60%+ of its code is now written by AI. Amazon will release 30,000 management level staff before the end of the year, apparently not replacing them at all. Again, “not AI”: they just don’t need them anymore.

Advice? Get very good at controlling AI. Be totally immersed in it. Subscribe to this free newsletter that tells you pretty much everything that happened in AI yesterday. Read it every day. Click every link. Join every Discord. In three months time you will know about as much as anyone.

In the book, people separate (or rather are separated) into groups. Those that control and design the machines. Next, the Reeks and Wrecks or “Reclamation and Re-construction Corps” a government works program. Finally, the army.

Suffice to say, being a member of the first group looked preferable to me, albeit I'm sure that is not the intended takeaway of the novel.

A global force

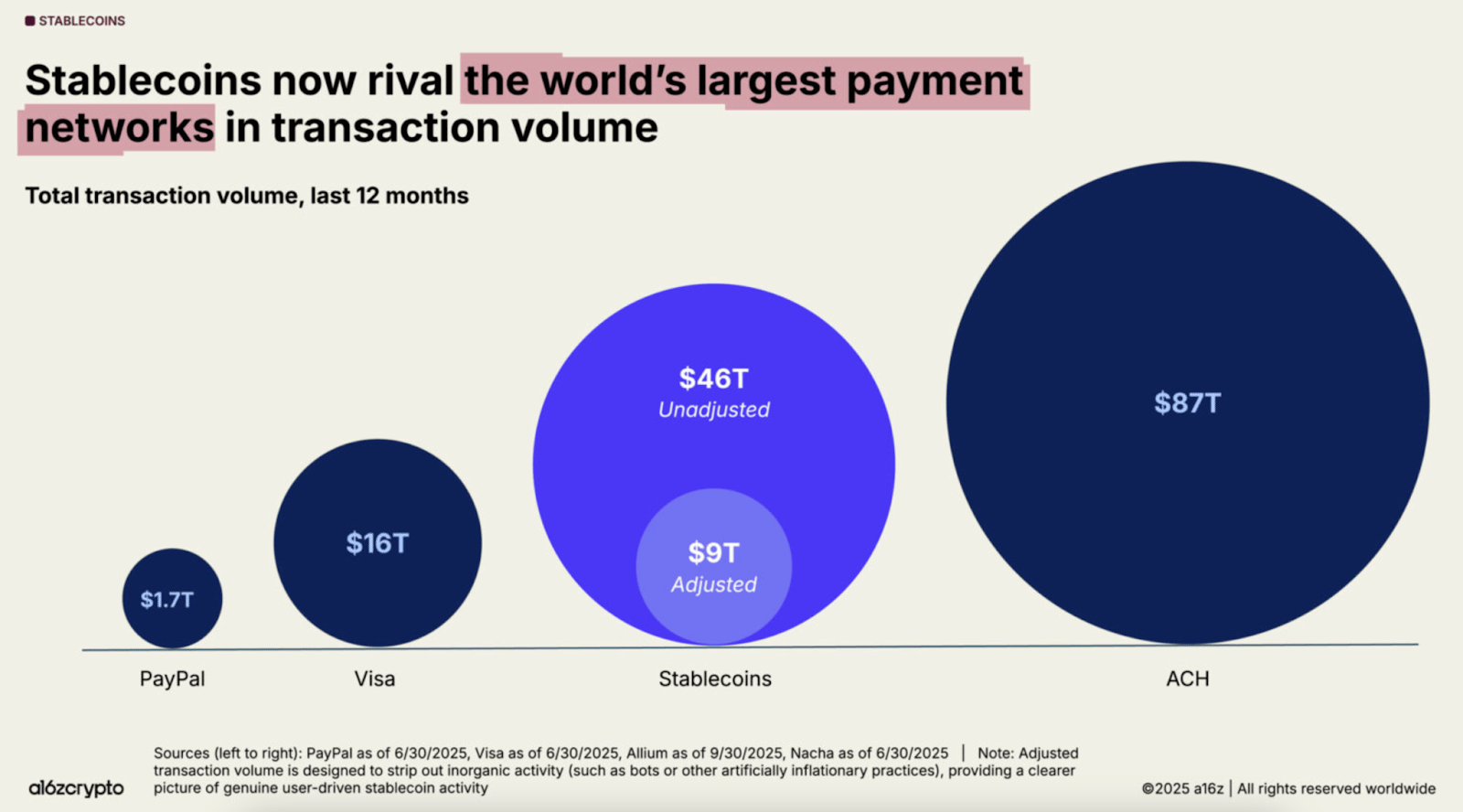

Andreessen Horowitz’s State of Crypto report landed this week. It is generally rather insightful. It points out the dominant force that stablecoins have become.

The headline $46T is unadjusted; $9T (adjusted for financial flows) feels closer to the mark. Still huge.

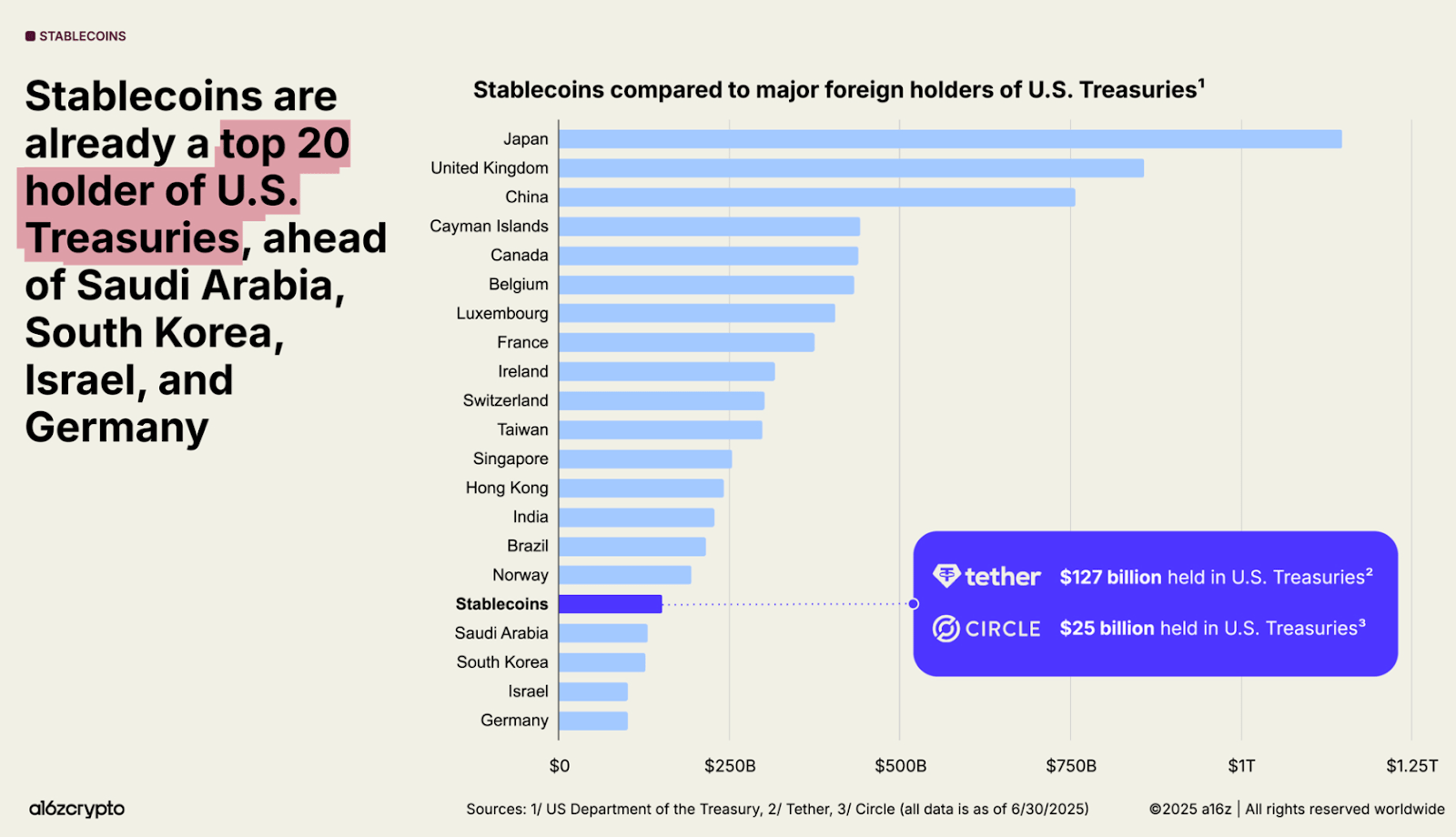

The global influence though really derives from the underlying treasury holdings. Tether alone now exceeds Germany in terms of its influence as an American creditor. If you want economic influence, holding nation state levels of American bonds and being a continual buyer is a very good way of doing it. Once the GENIUS act gets going, you can expect stable coins to jump into the top five on this list.

A Letter

A letter from the UK House of Lords. The Lords are concerned that American tech companies are not taking Britain’s “Online Safety Act” seriously enough. Apparently, platforms are not “quaking in their boots”.

Indeed.

Why? Because they don’t really have a leg to stand on. If some moron on Facebook wants to post something stupid it is a matter for them, I suppose. Not really a matter for Facebook or the House of Lords but they seem to be under the understanding that they can control the distribution mechanism of the internet via American tech companies.

It highlights something more interesting though. In last week's earnings surge, NVIDIA rocketed to 2x the value of Canada's GDP. Even on an earnings basis, Facebook has larger profits after tax than the GDP of Wales. Less impressive but a more like-for-like comparison.

The fact is, that the US tech companies do have more power than most nation states, they also have far better distribution. They can access people in a way that government propaganda cannot. Are they worried when Britain fines them? No. What happens if Google refuses to pay a fine? Perhaps the government would respond by telling them that their services in Britain are no longer required. That would immediately result in the British economy collapsing in a heap. They are totally reliant on American tech. The threats are totally meaningless.

The day draws near when one of these companies just says “if you want the money come and collect it yourself”.

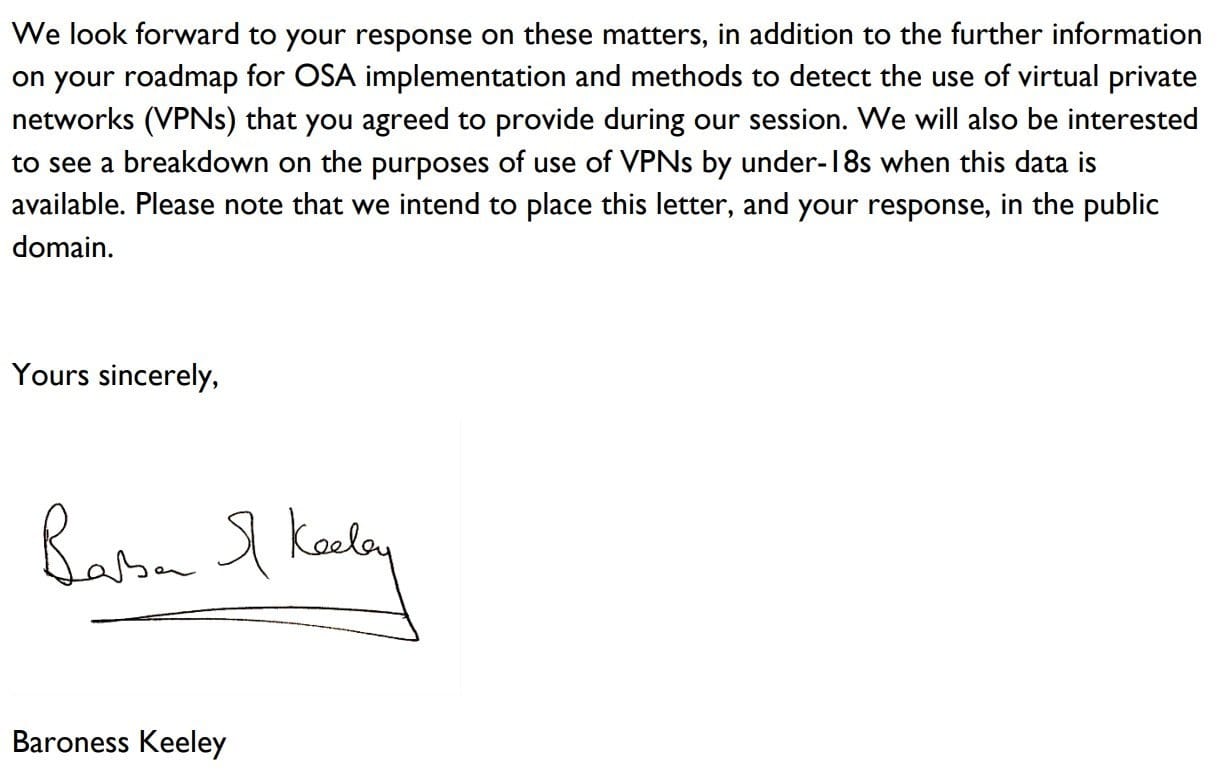

The letter from Baroness Keeley went on:

What an extraordinary way to sign off. Oh and by the way we’d love to know what everyone is using VPNs for, please make sure you provide that to us as well.

If that is not a gross invasion of privacy, what is? In unrelated news, if you haven’t watched this film, you really should.

$100k (again)

This was May, in which I referred to February….in which I referred to December (2024).

Now in November, and here we are again

Bitcoin dipped below $100k this week. If anything can be said for this visit it's that the day has finally arrived when $100k is frustrating and disappointing.

Progress, then.

Euro-Trash

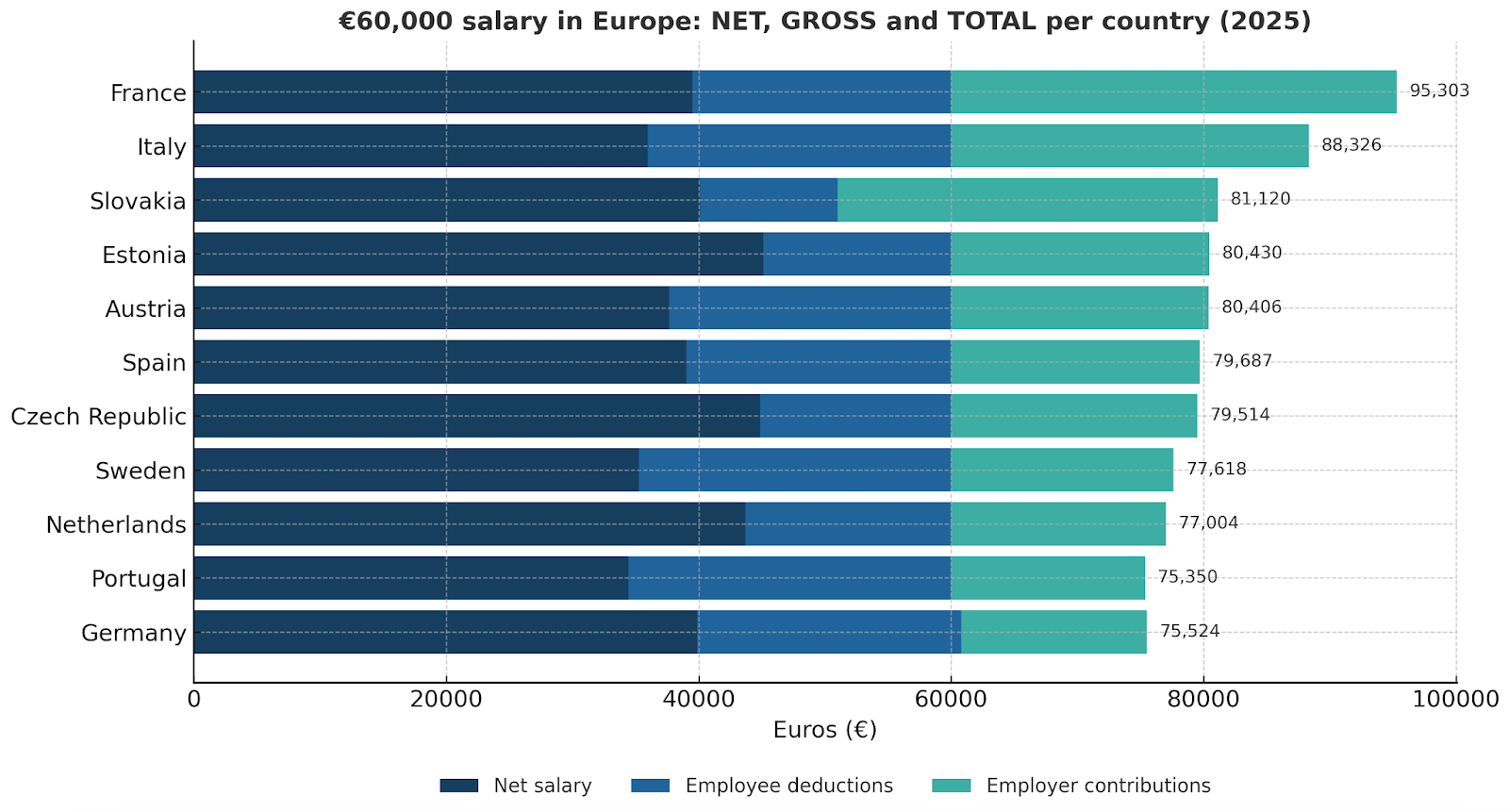

In France it costs an employer €95,300 in order to pay a gross salary of €60,000. The employee takes home €39,000. The burden of the state is simply huge.

In the earlier analysis of why it is very difficult to find employment, at least well paid employment, this is one of the answers. The cost of employing anyone is exorbitantly expensive.

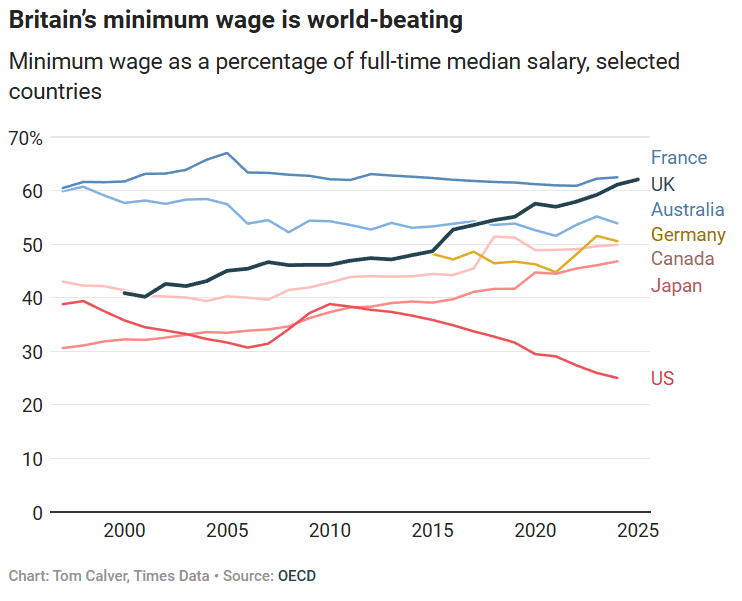

Not only are the additional costs in France high, the basic minimum wage cost is also huge. The next chart is rather misleading because the full-time median salary is a lot higher in the US than everywhere else. The fact that it is rising is causing the minimum wage to fall as a percentage. It is extraordinary though that the minimum wage in the US is under 30% of the average wage while it is over 60% in the UK and France. Where’s the incentive to do better?

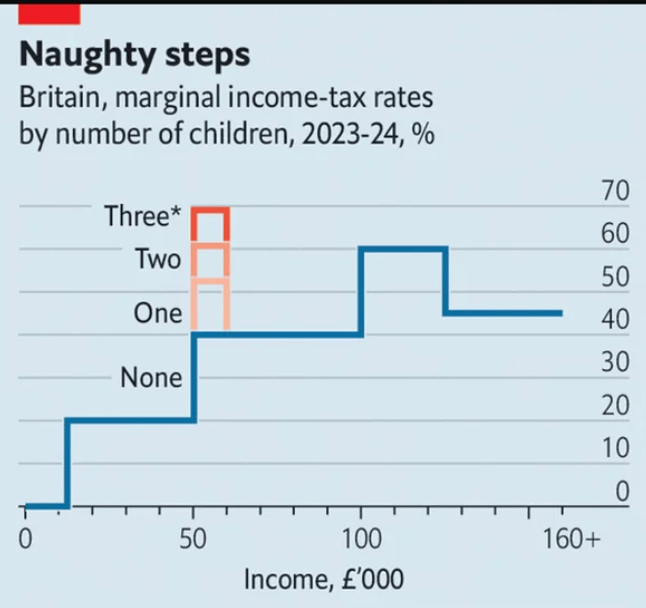

In the UK there are many tax cliffs which penalise people as their pay rises. As you approach £50,000 child benefits fall away. In the 23-24 tax year anyone earning £50-£60k with three children paid a 70% marginal tax rate. For two children 60%, for one child 55% (this has since been reduced by 5% in each category).

It gets bad again as you approach £100k and the personal allowance falls away. In the twilight zone of £100k-£115k you are back up to 60% tax. Even more absurdly, if you are a two income household both earning £99k, then you are considered less well off than a single income household on £100k. If you have three children, chances are someone is at home with them. The UK absolutely demolishes large families with one person earning.

The whole song and dance though is rearranging deckchairs on the Titanic. Employers have many options now rather than employing people, those options get better every month. They get orders of magnitude better every year. Soon, tax brackets won’t matter that much at all.

As the French and British governments wade through their ugly budget process they seem totally oblivious to the steam train heading in their direction. They move tax bands, subsidise child care, ‘tax the rich’, whatever. Near-free employment in the form of AI is here. All of it, American and Chinese owned.

Further Information

Our October 2025 report to investors can be found here.