- MoneyBits

- Posts

- The dirtiest coin

The dirtiest coin

Sunday looms, judicious use of technology, a slow death and rethinking bins.

📚️ PDF ⏳️ 8 min 📖 7

Sunday looms

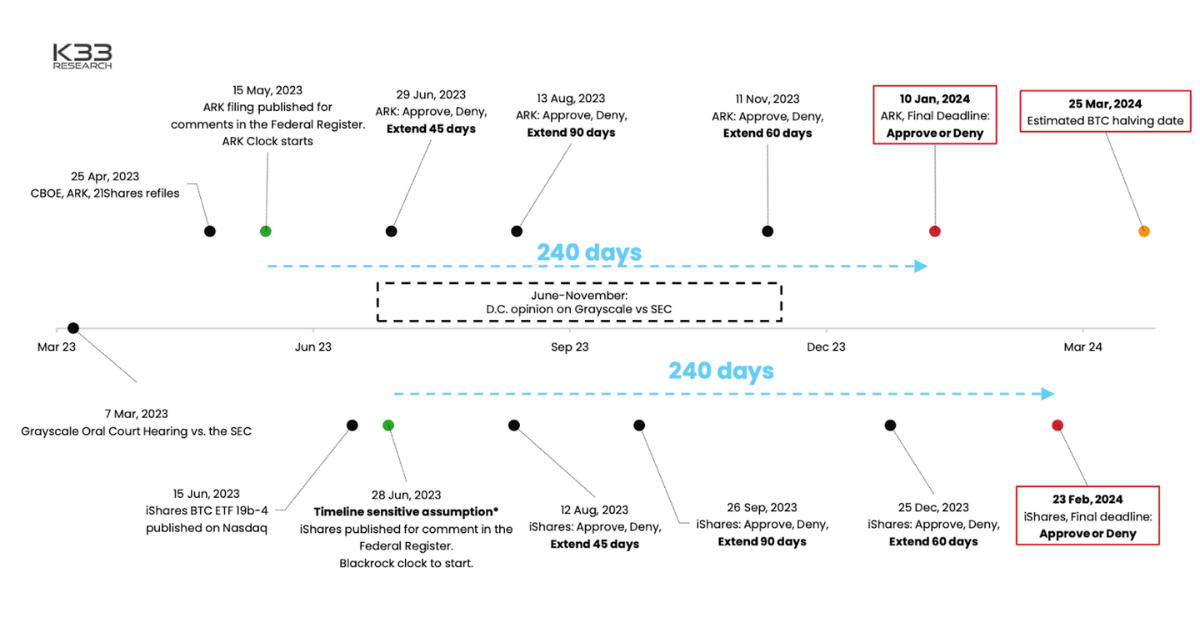

The saga of 'will they, won’t they' for US bitcoin ETFs reaches its next major milestone this Sunday. Back in April, Cathie Wood’s ARK Invest submitted their ETF application. We are now at the second Approve/Deny/Extend stage for the SEC.

The situation is rather complicated by the SEC being in court against Grayscale for approving a Bitcoin Futures ETF and denying a spot ETF. The case hinges on technicalities; I don’t believe the outcome matters that much because we will get a spot ETF in the end. The SEC is simply wrong and they probably know it but it might be more suitable for them to be ‘forced’ to approve an ETF by legal defeat than to actually approve one in the normal manner. “We are right but the court does not agree” might be better than “we were wrong”.

These are circumstances that could only really arise from a government agency with unlimited budget. If this were commerce, the SEC would have settled months ago.

The outcome on Sunday (we might hear later today), will almost certainly be to delay the decision by 90 days. Depending where they are with Grayscale in November, they can extend for another 60 days but the final judgement day is 10th Jan 2024.

Bloomberg’s ETF analyst James Seyffart gave his assessment as deadline day looms:

“Here's the race as I'm watching it. We are completely guessing on the timing of the Grayscale case dates. But we think the path of least resistance is simultaneous approval for all eight filers + Grayscale in the aftermath of the courts vacating the SEC's denial.”

Eight new ETFs on the same day might be something to behold, especially when they include Fidelity and BlackRock. I would consider this not very sensible because of the explosion of demand it might create but the SEC is such a mess these days that they appear to act according to whether they will or will not get sued rather than according to what is in the best interest of the American investor.

The dirtiest coin

The story of Tether, the USD stablecoin, is something to behold. To this day there is a large group of people that are determined that it is a fraud and will collapse. Launched in 2016, it had a steady start before reaching a market cap of $80 billion in late 2022, heights it recently exceeded.

Then the test came during the tumult of late 2022. $20 billion was redeemed in the space of a month and the question was, will Tether pay? They did, just like they always have.

Even then the criticism continued. Here’s a good example of the level of criticism from Marc Cohodes, perhaps currently the world’s most famous short seller. He’s no fool and is absolutely convinced Tether is a fraud and has said so for years.

For Tether’s part, they just keep going and growing. They released their latest audited reserve statement last week. You can find the full thing here. It’s extraordinary because they show that Tether now owns more US debt than Australia, Spain and the UAE and plenty of others. They have become a significant lender to the United States government. They are also now 104% collateralised. In contrast, capital adequacy at Australian banks is 18%.

The general view appears to be that Tether is a fraud because when they started they used dodgy banks all over the world (what choice did they have?) and were strongly connected with Chinese customers. Then their collateral wasn’t good enough, too much junk bonds; so they switched to almost 100% USG instruments. Still not good enough. Now the question is what are ‘other investments and secured loans?’

Personally, I’m not in that camp because the reality of Tether is so simple.

The man who runs it, Paolo Aardino (who is also the CTO of Bitfinex) basically does so in his spare time. Issues and redeems tokens from their wallets as needed and lets the Ethereum blockchain do the rest. Every time he does, someone shouts “fraud/ponzi”.

He is one person with a good idea, he executed well, he was honest and paid people when they asked to be paid. He beat the New York Attorney General when they tried to take him down. He took risk. Now, his business is massive. I guess he spends a day a month on it and it’s on track to make US$6 billion in profit this year, more than BlackRock and more than CBA just made (A$10bn).

It is just possible that it is a demonstration of what can be achieved with the judicious use of technology over a product that everyone wants and uses (US Dollars).

So it’s one of two things. A fraud, or people are jealous of its success.

My guess is it’s the latter.

Ratings

The mighty United States lost its Triple A rating last week. They dropped to AA+. There are few countries now holding onto the top tier rating, Australia remains one of them.

I wonder; will everyone that uses a risk-free rate in their spreadsheets now drop the American 2yr yield from their models, preferring Luxembourg's bonds? Almost certainly not. That fact alone should tell us that the rating agencies have not recovered from 2008 and neither should they. There is no more compromised and discredited group emerging from that era than them.

When news broke of the US downgrade, nothing happened. Bond yields quivered for about 5 minutes.

The bottom line is that the Americans will pay, and in all likelihood they will pay with printed money and you don't really care because you will get your money back and it will have lower purchasing power than it had before and you will get some interest and that’s the arrangement.

Moody’s, S&P and Fitch. Grifters from another era; news that would once have rocked the financial world meant nothing. Nobody cares and neither should they. A slow death beckons for these charlatans.

260 days to go

There are 260 days to go now until the bitcoin halving. In April next year, the new daily supply from miners will drop from 900 each day to 450. That itself is only one component of supply but it is definitive and cannot change. Another is how many bitcoins are sloshing around on cryptocurrency exchanges. For each epoch (lasting four years) exchanges have hoovered up coins at a record pace. The current epoch is different though, exchange balances have fallen (on average) every day and I expect they will keep falling.

We live in a world of plenty, more can always be produced as we get better. We were running out of oil in 1970, got better at finding it, now there is more. We were running out of food in the Malthusian era, it didn’t happen, we just got better at producing it.

We will not get better at making more bitcoin. I don’t really think it’s a well understood dynamic and slowly but surely those bitcoin’s are being squirrelled away by those who have understood.

The Bitcoin supply curve looks like the dotted blue line. Its rate of growth really starts to slow at the last halving in 2020 which is exactly when exchange balances started falling.

In theory, at constant demand the price should ‘steadily’ rise. At anything approaching growing demand something more explosive will happen.

In short. There will be less, people will demand more, the price will rise. I think it is that simple.

Lots of very clever people don’t think so. They tell me that the ‘unregulated monetary premium of the asset is arbitrary and it will be eroded by superior CDBC technology that will be licenced by the government and undermine the scarcity of bitcoin, eroding away the technological advantage of speed and convenience’.

We’ll see.

Euro-Trash

The votes on what should be on the new Euro notes are in and counted. Nearly half of all respondents were German, which probably reflects the fact that they fund the entire Euro operation and should be allowed to choose who goes on the notes without reference to anyone else. I was looking forward to seeing Becker and Beethoven smiling back at me but the ECB intervened.

“A group of people who represent the diversity of the euro area population”. A euphemism for some people who aren’t German I suppose.

The absence of sanity continued. The ECB released its sustainability report for 2022 where they lay out their environmental objectives and how they are tracking them. One of their many successes was the ‘meat free day’ which was introduced in staff restaurants during the year.

I have no idea if this is environmentally beneficial or not; I’m almost certain though that if the shoe were on the other foot and a meat only day were introduced there would be outcry. What happened to choice? If you want to eat meat or vegetables it’s really up to you. Since when did employers get to dictate the diet of their employees?

This seems like a reasonable benefit for staff, particularly in Europe where cycling is popular but aren’t we losing sight of the objective here. The ECB has only one: keep inflation at 2%. As I have pointed out before they don’t even have to worry about unemployment like the Federal Reserve does. It’s not in their mandate they simply need to keep one number at 2% and that’s all. They have unlimited resources to do it and undershot for a decade by 50% and now they are overshooting by 500% and they are spending their time fixing punctures.

Here’s another, complete with spelling mistake.

A video for staff on the safe charging of electric vehicles? You plug them in. There isn’t anything else, what will be in the video?

Finally I got to this one and gave up.

Any organisation that comes up with this does not deserve to exist. It simply defies belief. Rethink the position of the bins … if that’s not bad enough, they couldn’t decide. It's pending!

Further information

Read our bitcoin news wrap-up on Livewire: Laying the foundations for increased flows into digital assets.

Our July 2023 report to investors can be found here.

If you are considering an investment in the Managed Fund, you can now apply using our online application form: