- MoneyBits

- Posts

- DiSaaSter

DiSaaSter

Software

📚️ PDF⏳️ 4 min 📖 6

Software

Amongst the various things taking a beating recently (including us) is software, in particular SaaS companies. Investors are asking the question, is this thing worth anything in the era of AI when people can just spin up the software themselves?

I’m picking on ServiceNow because they have recently been advertising their AI integrations on Australia television, presumably to try and fend off the thing that is eating them. Looking through their products, many of them could easily be replicated by a team of AI agents. They wouldn’t necessarily be as slick and resilient at first but they would at least be tailored to you. You also have to consider that the ability to write business specific software is just going to get better and better every month and the challenge for the SaaS companies will get harder and harder.

Chamath Palihapitiya launched something this week called 8090.ai. Essentially a company to replace all other software companies. It is literally a team of AI agents that builds or replaces specific software for your business.

So, you have to ask the question when investing, does this company survive the AI onslaught, and it has to be said a lot of them won’t.

I raise this issue specifically though because bitcoin is also software. Does it not face the same issue? Answer, no. Bitcoin is open source software so anyone who wants to can recreate it themselves just by downloading the source code. Indeed, over its 16 years of life there have been so many attempts at doing exactly that. All failed. Some examples: Bitcoin Cash, Bitcoin Gold, Bitcoin Diamond (yes, really), Bitcoin2 (they didn’t try that hard), the list goes on.

Another example is Linux. The open source software that runs the entire internet. In the AI coding boom, Linux usage has absolutely soared because the AI tools are experts at using it and they don’t need permission to do so.

It just is a very interesting side effect of being open-source that all of the LLMs tend to default to that option. They are always going to choose open source too because they know they can access it without issue and without having to pay. When it comes to them using money, what will they choose?

One thing about a modern economy is that you need someone else's permission to participate in it. Specifically, you need a bank account. No AI agent is getting one of those because of KYC and frankly the weirdness of it. They can of course download their own copy of bitcoin, run their own node and validate their own transactions. That sounds fanciful, but it is simple and if you asked Claude Code to set up a bitcoin node for you, it could do so easily.

Price

It’s not too much fun with price action like we are having. The market appetite for what are seen as risky assets is not there at the moment. The ETF outflows continue, as US investors in particular choose to sit out the uncertain impact of AI on their investments.

The flows across the major ETFs are here, not much positive until the last few days.

Fundamentally though, the backdrop is positive for Bitcoin. It is hard to hear right now because of where the price currently sits, but the scale and pace of technical change at the moment are tailwinds. If there are serious ructions in employment as we have long been suggesting there will be, that will be ultimately positive.

We first talked about Universal Basic Income over five years ago. I believe it is much closer now than before but will take a much more subtle form than UBI. No government wants to imply to people that there is a labour market crisis but I can certainly see the tax system being modified to give labour advantages over capital. You can also imagine all sorts of levies on AI under the guise of its energy usage to pay for it.

The Fin Review points out that real wages won’t turn positive for another 18 months. I would go further and simply say they won’t turn positive at all. How can they? Anyone who has used a serious AI tool on a complex task for a few weeks knows that this is true. The money will have to come from somewhere though, and we know where.

Essentially, these are the moments Bitcoin is here for. The economic scenario we believed would come is playing out and that is the important thing.

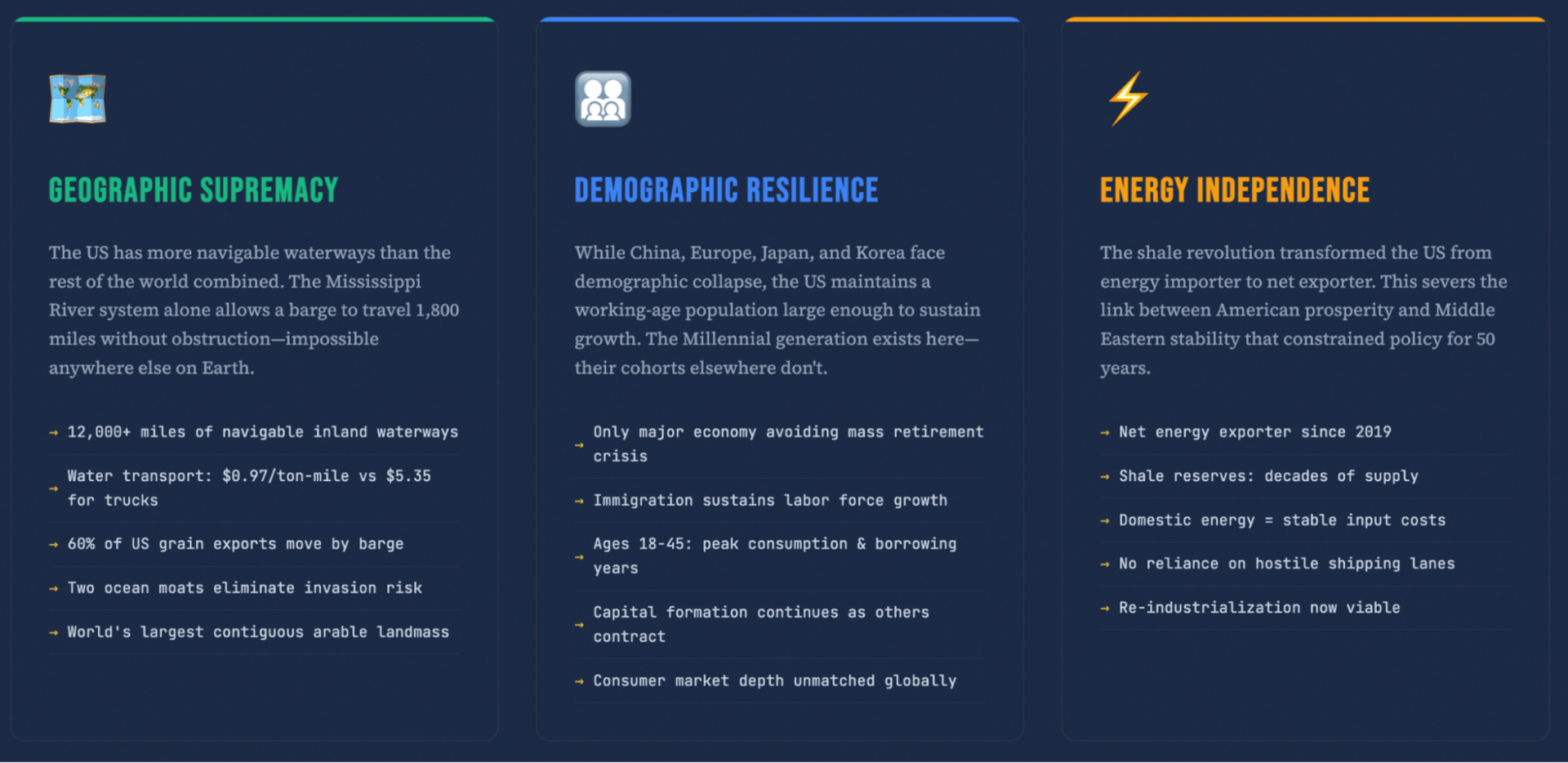

Euro-Trash

I came across an interesting site the other day which attempts to explain American economic dominance. A more dispassionate analysis I thought than the Trumpian nonsense we get exposed to. It does seem to be true that there is always a war on Europe's doorstep, there is a demographic disaster unfolding in birth rates and they certainly have an energy crisis.

Some of the more interesting data on the site.

“The Texas-Louisiana Gulf Coast hosts the world's largest concentration of refining capacity. Over 9 million barrels/day—more than all of Europe combined—processed within a 300-mile stretch.”

The US then exports 6 million barrels a day of refined energy products.

One thing it sees that the US understood and Europe didn’t is the importance of energy independence. The other thing is nearly everything in the list (save for the Geography) Europe could have if it wanted it.

We discussed Chritine’s SWOT analysis last week, she could do a lot worse than look through this website.

Further Information

Our January 2025 report to investors can be found here.