- MoneyBits

- Posts

- Lights out

Lights out

ECB turns lights out to hide $7 billion loss

📚️ PDF⏳️ 8 min 📖 7

Unrealised CGT

It's only on superannuation, it’s only on balances over $3m, it only affects about 80,000 tax payers. Less than half a per cent of the population. It’s a nothingburger. The general reaction suggests to me that this argument is winning. Most people are not concerning themselves because they are not really in any danger of ever having that much super.

The policy reflects the near total intellectual deficit that exists in Australian politics. The current crop seem to be at best mid-wits, at worst outright thickos, with no deeper level of thought into what they are doing or saying.

Let’s take the proposal. Say you have $3m in super. The year ends, now you have $3.1m. The government sends you a bill for $30,000 (a 30% tax no less). You don’t have any cash though because you didn’t actually sell anything or even make a real gain. So you are forced to sell something to pay. Arguably you could say at that level people can come up with $30k if they shake the tree a bit. What if they have a good year though and $3m becomes $4.5m (on paper)? Can they come up with $500k? Incidentally, if those assets then drop to $2.8m. Bad luck, no tax credit for you.

Essentially the environment is now created in which assets in Super over $3m do not really belong to you. if you have a good year, whether you want to realise the gain or not you will have to sell. It is the end of private property. Specifically, this is what I mean about the gross intellectual deficit in politics. You wouldn’t do this if you actually understood what it meant. Property Rights are fundamental to functioning economies; it's an absolutely profound shift for Australia.

What is worse, the government has not indexed the $3m. Gradually it will creep down the tree until it encompasses far more Australians than ever realised what inflation does to them. It is an enormous breach of trust too. To allow people to build up wealth in a vehicle the government promoted for so long only to pull the plug later. Keating introduced the modern super scheme in 1992, some 33 years ago. There will be people who saved hard under that scheme believing that the government had their backs. Now, as retirement beckons it must be tremendously galling to have this happen.

Keating, Australia's most recent intelligent Prime Minster, has described the lack of indexation as "unconscionable", a generous appraisal. That is evident in the government's forecast of tax take which rises sharply as inflation and investment gains draw more and more funds into their tax net.

If the government is forcing people to sell assets because they are “too wealthy”. Isn’t it Marxism?.

All of this has been long predicted. My favourite book, The Sovereign Individual had this to say:

"In the new millennium, the ability to tax or confiscate wealth will be greatly reduced. As income and assets become more intangible and transactions move to cyberspace, governments will be less able to force asset sales or impose capital levies. As wealth becomes digital, it becomes much harder to seize forcibly."

In Norway, the 1.1% wealth tax actually caused a significant drop in the tax take as wealthy people simply left. Same happened in the UK with the non-dom disaster (which exempted certain groups from tax on overseas income). They left, in droves, and London in particular is now a vastly poorer gangland as a result.

Australia will be worse off too and not just by the 30% tax.

Yield

Remember yield? It was promised across the sector by Celsius (bankrupt), BlockFi (bankrupt) and precipitated a general collapse three years ago. The assets do not generate yield. Bitcoin does not generate yield, it never will.

Stablecoins are a different matter. Tether has become one of the most profitable companies in the world by selling dollars backed by US Treasuries and then just pocketing the interest and moving to Lugano. They continue to do it to this day on an asset pool of $150 billion (of which $130 billion is interest bearing US treasuries). It’s massively profitable but cannot really continue.

The day will come when Tether will recycle a portion of the yield back into issuing Tether. So say they have $100, they get $4 from the US treasury. They will issue $3 of Tether, buy $3 more of treasuries and then distribute the new tether amongst the Tether holders. Technically it is easy because they have everyone's address and can simply issue to current holders.

In this case, there is yield, it’s just the interest on government debt. It will make a profound difference to the sector.

BlackRock has noticed the same thing. By tokenizing their moneymarket funds they can run a multi-billion dollar fund with just software. Once they do, Tether will do the same because they already run $150 billion with less than 50 people.

Tether today is just a giant money market fund that has a transport mechanism. So you can actually spend units of your fund. The price you pay for convenience is you currently don’t get an interest.

I suspect two things will happen here. First, their AUM will absolutely skyrocket into the trillions. Second, a very active market in bitcoin lending will spring from it because it is the perfect collateral against which to borrow for yield bearing assets. It might take a few years, but it’s BlackRock leading the way here.

XXI

Read the full story here. The essence is that 21Capital (whose new ticker will be NASDAQ:XXI) will raise money from investors and buy bitcoin and buy bitcoin based businesses.

Tether has already pledged $1.8 billion in BTC (so about 18,000 BTC). Cantor Fitzgerald is an investor, Softbank also. So far so good. But……there is general outcry from traditional finance persons.

“All they are doing is raising money and buying bitcoin! It’s a ponzi!”

But are you worried when your Super Fund raises money from you and buys commercial real estate? Are you worried when they buy into solar panels to green their credentials?

The digital equivalent of Manhattan Island is currently for sale. 21Capital is buying it. The new CEO Jack Mallers said "We're not here to beat the market, we're here to build a new one."

The question of what happens when investors do sell XXI though is valid, what happens? Well it will trade below NAV like real estate funds often do. I honestly don’t see the whole thing as that big of a deal. Other than to say, expect more of these vehicles to spring up as increasing number of entities start to believe in the viability of bitcoin as a long term hedge for value.

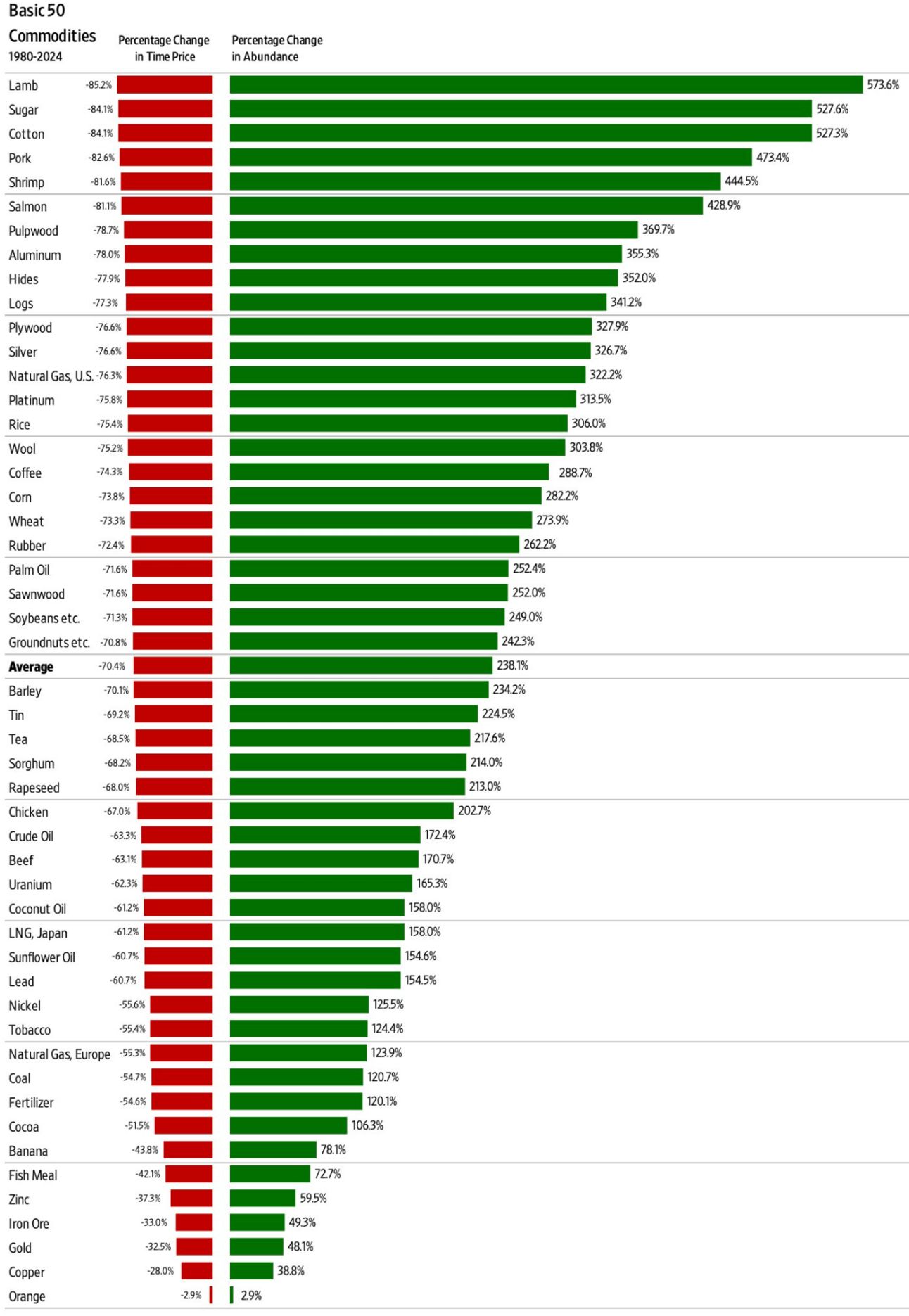

Human progress

So far then a rather depressing edition. Here’s a reason to be cheerful. We aren’t going to run out of anything and we never have. One thing not on the chart is access to intelligence, which in the last 12 months must have risen by an order of magnitude. The benefits will flow. Personally I think it will be a tidal wave of abundance and creation. Still it’s probably more fun to be miserable, so I’ll keep doing that for a bit.

A much fuller article can be found here Simon abundance index.

Euro-Trash

Christine Lagarde visited Portugal’s Central Bank on Monday

Perhaps you won’t run out of anything, provided you don’t live in Portugal or Spain. They suffered 36 hour energy blackouts on Monday and Tuesday across the entirety of both countries. There are lots of explanations about ‘energy inertia’ and other things but the reality is they have unreliable grids which are heavily solar reliant. Nothing wrong with that except it turns out to be incredibly hard to restart your grid if you are solar dominant. Jump leads can’t reach the sun after all.

At some point there has to be a reckoning with the fact that energy use must grow for wealth to grow. It just is an absolute fact and however much we wish it would, it will never change. The fastest growing economies in the world are building power capacity at the fastest rates. Collapsing economies (South Africa) have collapsing grids.

Most of the commentary from around Southern Europe has been rather fun. Cooking on fires by candlelight and generally enjoying a couple of days off but they were 24 hours from total anarchy. All it takes is the generators to fail at a children’s hospital and it won’t be quite so amusing. Must they let it come to that before they do something?

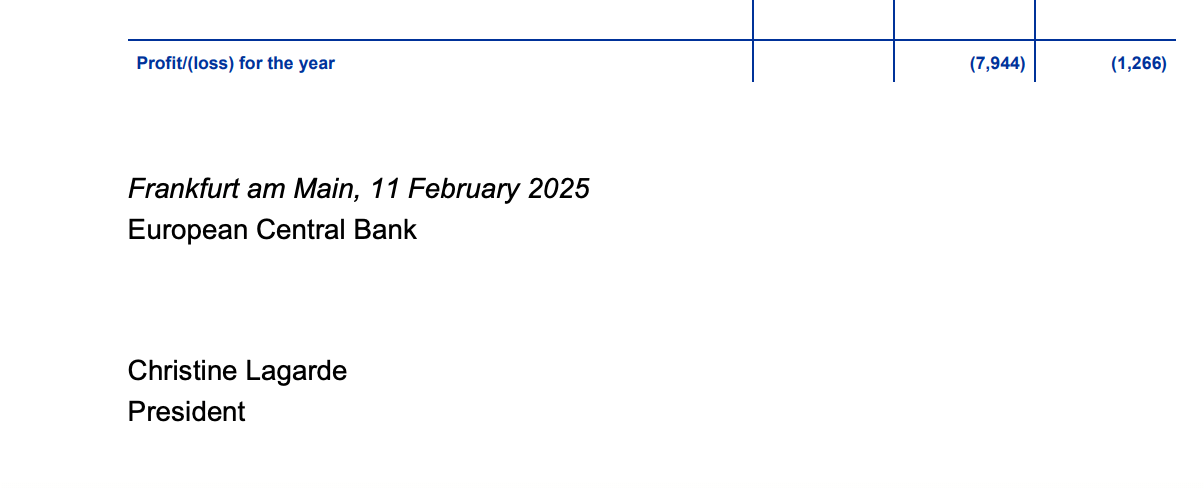

Elsewhere, the ECB Annual Report was out. Not much fanfare on this and no tweets about it from Christine. I thought it was odd. Turns out they lost €7.9 billion in 2024, which scarcely seems possible for the people that print the money but they have somehow managed it.

Not only that, the European overlords managed to slip in this classic line.

The ECB’s total operating expenses, including depreciation and banknote production services, increased by €198 million to €1,470 million (Chart 22). This was largely due to higher staff costs, reflecting higher costs for post-employment benefits arising from an amendment to the rules governing the ECB’s pension plans in 2024.

A casually huge increase in expense because of staff costs. You might recall from previous years, 25% contributions to the scheme (defined benefit, naturally) from the ECB and more than that for Directors.

Last year's pension cost was €124m. This year's total was €253m. It’s a ‘one-off’ change apparently but quarter of a billion on pensions in one year, seems like a lot to me.

Further information

Our April 2025 report to investors can be found here.