- MoneyBits

- Posts

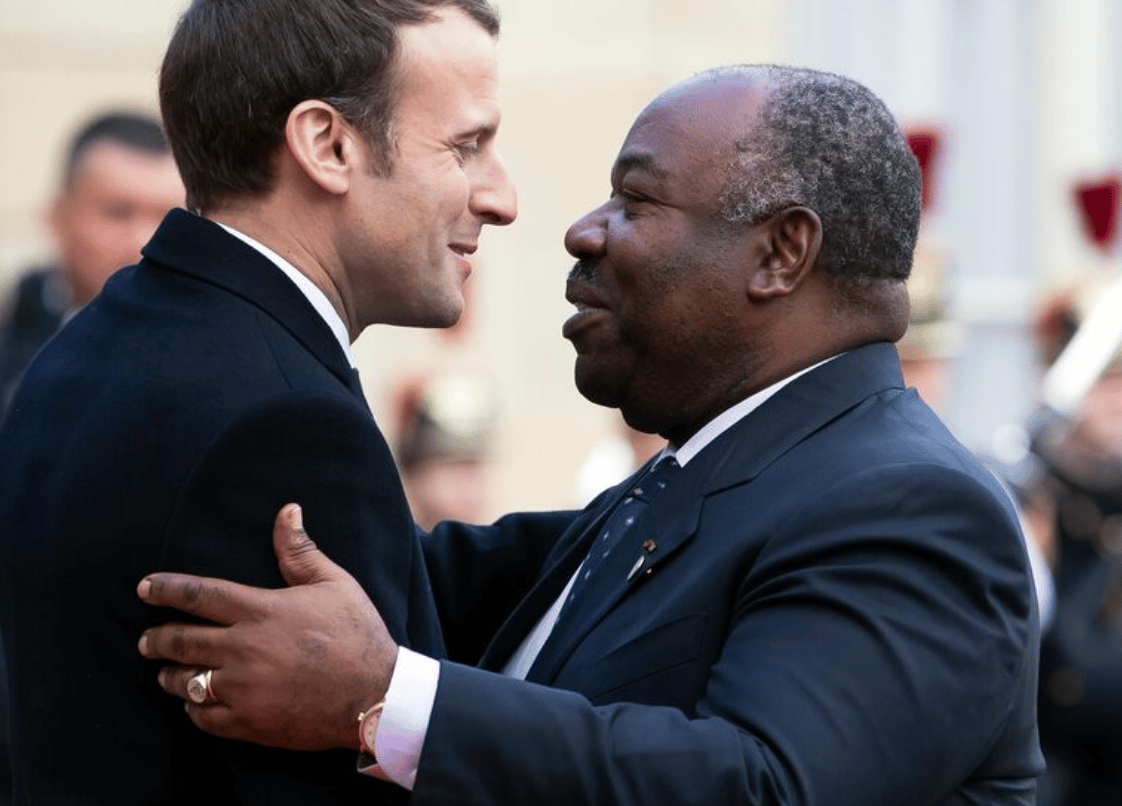

- Macron plays Bongo

Macron plays Bongo

Cartels, Argentina's decay, a subtle tool of slavery, and on the road to demographic and technical death.

📚️ PDF ⏳️ 8 min 📖 8

Narcos

Those of you who haven’t watched Narcos are missing a treat. Released in 2015, the final series aired three years ago later to great acclaim. It was visually pleasing, atmospheric and unsurprisingly, given the product they were shifting, highly addictive. The story depicts the progression of Pablo Escobar's cartel in Medellín, Colombia and his run-ins with his competitors down the road in Cali. A masterclass in business, political bribery and profiteering.

Cartels are generally highly profitable because of their ability to restrict competition which keeps prices artificially high. The Narcos do that through violence, they kill their competitors. Lawyers do it through the Law Society and the Bar. Banks do it by closing competitors accounts for KYC reasons. The strategy is the same.

It is striking then that perhaps one of the world's largest cartels is so rarely discussed given that nearly everyone uses them. Jointly, Visa and Mastercard have seen their profits increase 40-fold since 2004, far in excess of the growth of the global economy. How so?

Original source: chartr.co

The main function driving these profits is the ‘interchange’ fee. These fees are collected by the bank that issues the card, like Commbank or NAB. The more they rise, the more Visa and Mastercard can charge the banks. It is the hidden fee that both banks and the payment networks profit from consumers on. All retailers must have Visa and Mastercard; all banks must have Visa or Mastercard on their plastic. There is no scale alternative (not even Amex).

The whole thing is very elegant because as far as the consumer is concerned ‘using my card is free’ except that, were it not for interchange, everything you purchase would cost 2-3% less. It is most certainly not free.

The grip they hold on both payments, retailers and banks is something to behold. Their industry is ripe for destruction because they are the middle man that ‘simply’ passes money from one person to another.

The proof of demand for an alternative is the volume settled by USD stablecoin Tether. It exceeded that of either Visa or Mastercard. Tether settled $18.2 trillion in volume last year. It is for exactly this reason that PayPal launched their own stablecoin recently. I fully expect Visa and Mastercard to do the same. The innovation in payments is not coming from the incumbents. Tether will make in excess of $5bn this year, less than the others but given they don't charge any fees and their headcount numbers are likely less than 10, it remains probably the most profitable business in the world.

Original source: we drew this one

Cartels like this are everywhere. Qantas is mired in drama at the moment because of its successful capture of the Australian political community which keeps overseas airlines out of the domestic market.

Australia itself has four banks. There are over 90 Authorised Deposit Taking Institutions but who do you know with an account at The Broken Hill Community Credit Union Ltd?

Escobar was famous, but he couldn’t not hold a candle to the real global cartels. They win awards, hang out with politicians and generally inhabit the moral high ground while all the while protecting their positions with something I will call ‘financial and regulatory violence’. It is clever and successful.

Where are they?

In March 2020, Coinbase held 1,000,000 BTC on their exchange. Over the course of the next three years the price visited US$69,000 and US$8,000 (during the Covid collapse). Now, with the price sitting somewhere in between, Coinbase holds only 439,000 BTC.

Original source: ‘Glassnode; balances on exchanges stacked’

We should of course expect this. Over time exchanges will become less and less relevant particularly as institutional players find direct sources from miners and others to buy coins. Still, I was surprised to see Coinbase holding a balance similar to their 2015 numbers.

It is very hard to make an assessment of such a limited supply asset because nobody really knows. I can’t vouch for the accuracy of this tweet. Val is in fact a dentist from Florida and a seemingly self appointed expert on ‘vital resources’, so what would he know? He does highlight the point that in almost every case (apart from this one) supply always responds to price. Always.

That will not happen with Bitcoin because it cannot. We have never seen that before so it makes predictions hard; other than that something surprising will happen.

My main prediction then, looking at the Coinbase numbers, is that we will be surprised.

Parabolica

This particular instance of charts is simply an exercise in “can we draw parabolas?” The first two that came up were these.

Source: United States Federal Reserve

Once interest payments hit that parabolic pattern, it's hard to turn them around. Method one is to spend less and repay some debt; that is not going to happen in an election year. Method two is to dramatically reduce interest rates by almost any means possible, I suspect that route will be preferred.

The other possibility is just losing control completely. This has been ably demonstrated by Argentina, whose currency performance against the USD has a familiar look about it.

Argentina’s decay has been far faster than America’s but the path is essentially the same.

Central African Franc

This slightly misleading quote, should have the suffix ‘to terrorists’. Macron’s argument is that were it not for French military intervention, Burkino Faso, Mali and Niger would have fallen into the wrong hands. At least ‘wrong’ is his view.

This week it was Gabon’s turn. Another country that uses that famous tool of colonialism: the Central African Franc.

“The coup puts France in a difficult position, given its close relationship with Ali Bongo, and it might feel pressure to intervene militarily, given that Ecowas already has its hands full with Niger. French influence in a region it once saw as its imperial backyard has taken a battering in the past two years with coups in francophone countries such as Mali, Burkina Faso and now Niger.”

France is indeed losing its grip in Africa. Perhaps the reason is that the Africans don’t want to be told what to do by a Central Bank they did not vote for via a weaponized currency they cannot control. The Foreign Legion is arriving this week, so you can fully expect Mr Bongo to be restored to power quite shortly.

The pressure builds though. The CFA is a subtle tool of slavery; its inherent corruption simply invites coup’s since any independent leader that tolerates it can be accused of being in the pocket of a foreign power. If you were to google ‘Bongo and Macron’ in a google image search you will find at least 50 different versions of this; and if you scratch my back, I’ll scratch yours.

Euro-Trash

“Weakened”. As we have seen over the last few weeks, it's been on one leg for twenty years, Germany has fallen off a cliff and the Euro zone has lost half its relative size to the US economy in the last decade.

The full article is just remarkable. It’s odd to me that economists still talk about the Phillips Curve, the apparent correlation between employment levels and inflation. It is surely an outcome and not a targetable vector; this nonsense about ‘the slope of the Phillips curve’. Phillips came up with it in 1958, a lifetime ago. It is now only invoked when it is convenient to the government administrator who then ignores it when it is not.

So what to do? The answer is to pursue productivity growth. As a central bank how do you do that? You get out of the way. It really is that simple and yet in Europe we have a huge movement to control Artificial Intelligence.

They will almost certainly regulate before the US and in so doing, do the US a huge favour because no sane capitalists are starting an AI business in Europe. Those businesses could very well form the backbone of the entire global economy in the next decade. The Americans are not stupid, it’s an absolute gift for them which they will gratefully accept.

Back in July I referenced a report from the ECB about jobs and AI. It overwhelmingly found that the more such technology was in use the more it benefitted jobs and in particular young people.

The European Union AI Law looks scheduled to be passed later this year. Minter Ellision provided an elegant summary here proposing that Australia might consider following this model. Could there possibly be a worse regulator to follow than the EU which has a habit of strangling any innovation or growth?

Minters suggest that the law will have ‘extraterritorial impact on AI development’. I doubt that. The EU was the last to get GPT. After the disaster of their GDPR which continues to drag the large American tech firms through the mud, are we really saying that OpenAI will hold themselves back because some bureaucrat in Frankfurt doesn’t like it. The chances of the entire EU market being circumvented by tech firms grows with each passing year.

An entire, once rich, continent that was the inventor and producer of great technology is now on the road to demographic and technical death.

Charts

Lots of emails last week. Thank you. Specifically on charts, the new style uses Excalidraw. It's an open source drawing tool (and free). At first glance it is rather hard to use but the more you use it the better it gets. We’ll see how it goes and report back. The original source will be included underneath where there is one. If you want to learn how to use it, the entire YouTube series is here; a man called Zsolt Viczián has seemingly dedicated two years of his life to explaining it all.

Further information

Read our bitcoin news wrap-up on Livewire: Bitcoin industry news for August 2023.

Our August 2023 report to investors can be found here.

If you are considering an investment in the Managed Fund, you can now apply using our online application form: