- MoneyBits

- Posts

- Schaafted

Schaafted

.....by the Genius Act

📚️ PDF⏳️ 7 min 📖 7

Panic

Rarely do we open with Lagarde, but she’s been forced into action by the United States Genius Act. As a quick refresher, the act will allow US banks to issue stablecoins provided they are 100% backed by US Treasuries (90 day maturity and less). It digitises the US bond market and turns it into dollars. Will it create more demand for dollars? I think so. Therefore it will create more demand for US debt.

The speed of response from the ECB suggests some appreciation for how profound this shift might be.

Jurgen Schaaf - remember him? (The ‘Bitcoin ETF’s will fail’ guy).

“Stablecoins are reshaping global finance – with the US dollar at the helm. Without a strategic response, European monetary sovereignty and financial stability could erode. However, in this disruption there is also an opportunity for the euro to emerge stronger.”

In fairness to Jurgen he does at least call out the real threat to the Euro in the bowels of the report.

Lagarde then took to the stage (interest rates on hold by the way) and explained, “If we don't participate in digital innovations, we will lose our anchor role." She added that the ECB is committed to the digital euro because they need to meet with the ‘preferences of Europeans’. Presumably the same Europeans who never asked for a digital euro.

Things are moving very quickly all of a sudden. In the United States, they have effectively legalised the private creation of US dollars via stablecoins. JP Morgan Coin, Goldman Coin all worth $1 and backed by Treasuries. In Europe, the proposal is not the same, the digital euro will be backed by the ECB and run by the ECB. One asset is run by private enterprise; the other by Christine Lagarde and her 25% pension-contribution cronies.

There is absolutely no chance that the digital euro will compete here. They will likely be swamped by the speed of US innovation. It’s almost like the Americans have seen the issue (and there is one) and they have just gone for it. Let's hammer home our dominance by flooding the world with dollars via this mechanism. The European response will almost certainly be a €1,000 maximum per person, EU citizens only, and KYC only. Nobody will use it other than as a handy way of not getting mugged when visiting Rome.

This takes currency wars to the next level. Once it was about managing competitive devaluations. Now the distribution mechanism has been weaponised. Stablecoins were always hugely popular in our industry because they are useful. Their legitimisation is likely to see a massive increase in issuance. Even the ECB thinks $2 trillion in the next few years. I’d say much more.

It is not entirely fanciful that we get to the end of 2025 with $4 trillion in USD stablecoin issuance. Keep in mind that the Euro bond market is €12 trillion in total. Those bonds have to compete for investor money and the US has taken a massive leap forward in funding their enormous deficit.

Europe flat footed once again.

Strategy

The largest US IPO of 2025 is Strategy’s STRC raise. All $2.5 billion of which was deployed into Bitcoin on Wednesday. Saylor bought 22,000 coins and sure enough, the bitcoin price fell.

The product is a preferred stock that pays a monthly dividend of 9% (annual). That dividend is adjustable. The principal value of the instrument is $100. If it falls below that, Strategy can buy back or increase the dividend. If it rises, they can issue more STRC. There are some more wrinkles and complications, but that’s broadly it.

In essence, the product is saying “I think bitcoin will return more than 9% per annum over time”. It then provides a smooth mechanism to enjoy that gain. If bitcoin does indeed return more than 9%, STRC holders are only getting 9% and the outsized gain goes to the ordinary shareholders of Strategy.

It takes away the asymmetric possibility and returns that to Michael Saylor (who owns 45% + of the ordinary stock). In return, the investor has a reasonable probability of getting their 9%.

Strategy makes the argument that the product is ideal for short term investments who just need to put money somewhere for a few months. You couldn’t risk that with bitcoin, but you could with STRC and get 9%. A reasonable argument especially when you consider the demand for short term treasuries and money market funds. This is essentially a money market product backed by bitcoin instead of treasuries.

The product highlights that Michael Saylor has deeply understood bitcoin’s asymmetry. Now his company designs products that buy that asymmetry off people for what looks like a good return. It’s an arbitrage of understanding.

He would argue that he is taking on the longer term bitcoin risk in order to provide short term certainty to the investor. That is true, but in return he gets a potential unlimited upside and a capped downside. It’s an excellent product, for Michael Saylor.

The best intentions

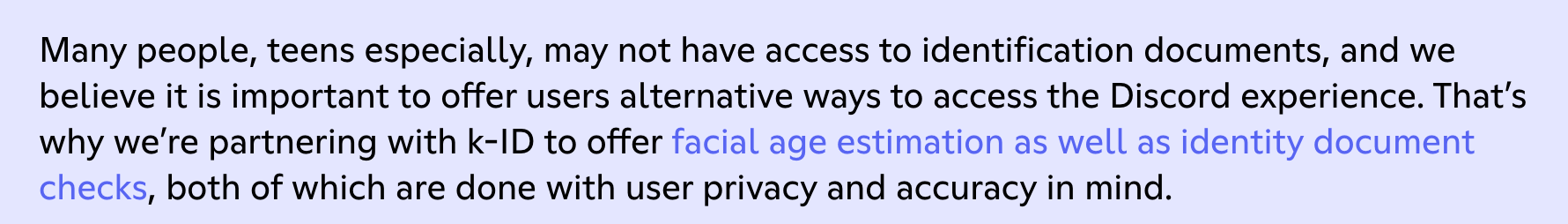

The United Kingdom’s online safety act went into force this week. It requires online service providers to filter content so that it is ‘teen appropriate’. Happily, even though none of them have ID the new facial age estimate technology will be there to help.

You look into the camera, it scans your face, estimates your age and away you go. Sounds like a new low in the UK-Dystopia.

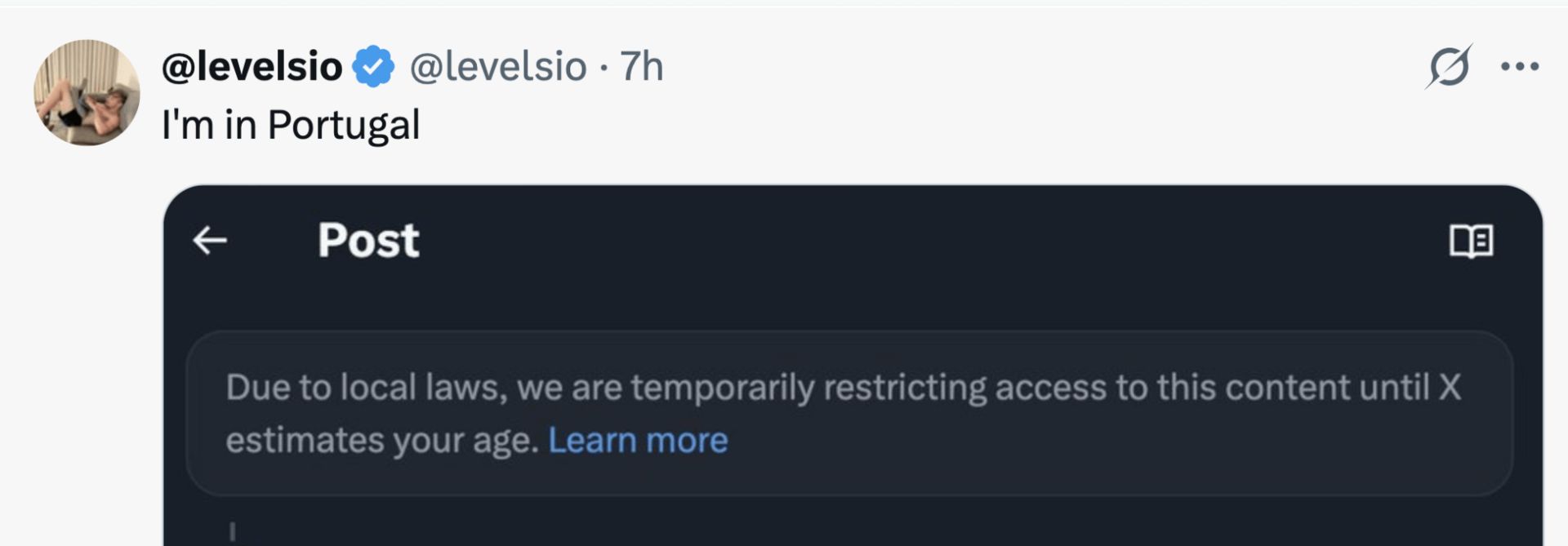

If you use a VPN, then the face ID will not be required. Many VPNs are free and they are not required to check ID. Most British teenagers are sufficiently savvy to just bypass the nonsense in two clicks. What’s more, the government is about to pass legislation allowing those 16-18 to vote. So you can vote, but you can’t use Discord?

The same nonsense around age-verification is coming to Australia later this year. It goes live on December 10th, curiously a few days after Parliament breaks up for two months.

Still, the UK Government explainer on all of this is hard to argue with. All the parental nightmares are duly listed. You would read it and say “of course” but reality is not like that. Would anyone engaging in the sorts of activities the Act anticipates willingly complete Facial ID verification? Almost certainly not. Perhaps more importantly the snapshot in the example above is from Discord, a platform with 150 million monthly active users. Some of the most cutting edge technology tools and explanations are launched on Discord Servers. Mostly because it is free, filled with computer nerds and allows for excellent topic management. Anyone on the cutting edge of technology is certainly on that platform. It is a digital Silicon Valley.

There are likely two main consequences of the new legislation, firstly UK user numbers will drop. Secondly, any new platform that emerges (and there will be new ones) will not go anywhere near the UK. You can’t bootstrap a platform business like that with your hands tied behind your back. The specific audience that bootstrapped Discord into a billion dollar business was gamers. A lot of them will leave and I would imagine they create something entirely new, outside of the purview of the United Kingdom and the European Union.

We all understand the intent, but the internet is not part of the state. The more the state legislates, the less internet you get. Here, once again, is the Chancellor of the Exchequer a few weeks ago.

Incidentally, the industrial strategy document (published in June) is most odd. I only bothered with the executive summary, but everything listed in there are the things they have legislated against (cheap power, innovation, less regulation, efficient tax system). It’s entirely performative.

Something to ponder

From the excellent blog Marginal Revolution.

In sum, I think it will take a good while before AI significantly lowers the cost of living, at least for most people. We have a lot of other constraints in the system. So perhaps AI will not be that popular. So the AIs could be just tremendous in terms of their intrinsic quality (as I expect and indeed already is true), and yet living costs would not fall all that much, and could even go up.

This seems to be the experience so far as well. The gains from AI seem to be concentrated in very few people. Specifically, those willing to engage with it and understand it. Take for example the people Meta is recruiting. Zuckerberg is paying them $300m to join because they understand very specific things at exactly the right time in the cycle. Meanwhile the relative salary capacity of nearly everyone else is declining.

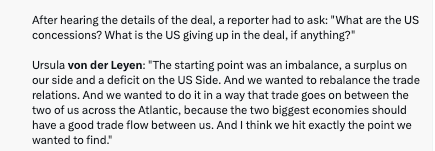

Euro-Trash

In fact, the EU got nothing from the deal. I can think of no better analysis than this from tech-entrepreneur Arnaud Bertrand.

If Europeans were paying attention (or being told the truth), they should be beyond appalled by this "deal":

It's nothing more than one of the most expensive imperial tributes in history. Just a massive one-way transfer of wealth with no reciprocal benefits

The "deal" is:

- The EU now gets charged 15% tariffs on its exports to the US when they commit to charging zero tariffs on US imports in the EU

- The EU agrees to invest $600 billion in the US, for no other obvious reason than pleasing "daddy"

- The EU will "purchase hundreds of billions of dollars of American military equipment"

- The EU commits to buying 750 billion dollars worth of very expensive US LNG, specifically $250 billion for each of the next 3 years

In exchange for all these concessions and extraction of their wealth they get... nothing. I'm not even exaggerating, that IS the deal: the EU gets nothing.

This does not even remotely resemble the type of agreements made by two equal sovereign powers. It rather looks like the type of unequal treaties that colonial powers used to impose in the 19th century - except this time, Europe is on the receiving end.

Indeed.

Why agree to it then? Well, Europe has no leverage, they have nothing to sell. They rely nearly entirely on the US for their defence while pretending that they don’t. They prefer to moralise and regulate than innovate to solve the real problems of the world. Look at the top 10 selling cars globally in 2024, I would have guessed at least 3-5 European cars, a BMW, a few VWs, maybe a Mercedes somewhere?……Nope. VW Tiguan ranks tenth; all other models are Asian or American.

Next, tech companies. Obviously, none of them are European.

I found those graphics on X from @levelsio. Underneath he had posted the following. I rest my case.

Further Information

Our June 2025 report to investors can be found here.