- MoneyBits

- Posts

- The squeaky earring

The squeaky earring

Property over burgers, amicus brief, PYUSD and the ultimate benchmark of sclerosis.

📚️ PDF ⏳️ 8 min 📖 7

Passive investment

My new favourite account on Twitter is StripMallGuy. He buys and sells small shopping centres in New York. If you are interested in commercial property in particular, he is a must-follow.

This particular tweet struck me because where do you find truly passive investments? People will tell you property is set and forget until they do it and realise it is a never ending saga of repair and dispute; with agent, tenant or council. If you want a heart attack I would recommend property over burgers.

Then they tell me equities; but they are a hidden den of vipers. Particularly large listed companies which have a class of insiders who spend their day devising schemes to enrich themselves at your expense. It is ‘passive’ but absolutely at your personal cost if you aren’t watching carefully enough.

So bonds then? Nope. Bonds pay their fixed coupon but again your value is withered away by the purchasing power of your principal. In this case, the government is hard at work eroding your value while you sleep. Nobody got rich from bonds other than the people who sell them to you. Bond traders are often wealthy; but only because they are agents of the government selling this garbage to unsuspecting pensioners. “Look, over here!!! 6.5%”

The obvious conclusion you are expecting here is that bitcoin is a passive investment. When compared to other asset classes it does not suffer the same weaknesses. Having said that, as a long term investor, I feel like I’m 172 years old. So, it's passive in the financial sense but comes with its own unique psychological overhead.

Amicus Brief: SEC v Coinbase

An "amicus brief" (from the Latin "amicus curiae," which means "friend of the court") is a legal document that's submitted to a court by someone who isn't a party to the case. These briefs offer additional information, expertise, or perspective on an issue in the hopes of assisting the court in making a decision. They are especially common in appellate cases, including those before the U.S. Supreme Court.

An amicus brief is not itself evidence but guidance to the court on matters of law. Sadly for the SEC, a group of six law professors have submitted an amicus brief to the court in support of Coinbase. It's not from random hopefuls either. They are the leading securities law scholars in America from Yale, UCLA, etc.

The brief itself is here. It overwhelmingly supports the Coinbase view that secondary trading in crypto-tokens does not create investment contracts, specifically:

1. "By 1933, the state courts had converged around a standard for interpreting the term 'investment contract' to mean a contractual arrangement that entitled an investor to a contractual share of the seller's later income, profits, or assets."

2. After the Howey decision in 1946, the "common thread [for investment contracts] remains . . . that an investor must be promised, by virtue of his or her investment, an ongoing contractual interest in the income, profits, or assets of the enterprise."

3. "Every 'Investment Contract' identified by the Supreme Court Involves a contractual undertaking to grant a surviving stake in the enterprise."

The SEC will lose. However, it is America, so they will find a way of letting their government agency lose gently. We should also not lose sight of the fact that this is about secondary market trading by exchanges. The people creating these tokens and selling them to the public are in a rather different position as Ripple is finding out.

Pesos

Back in 2018, Argentina was in real trouble. About to default on their debt it was truly a crisis and we sent the best we had to help them. Christine Lagarde.

They had defaulted eight times before, but this time it would be different. Lagarde was defiant and she organised the biggest debt deal in the history of the IMF, $57 billion. She helpfully explained the brilliance of her plan:

“In the event of extreme overshooting of the exchange rate the central bank may conduct a limited intervention to prevent disorderly market conditions,” Lagarde told reporters.

Fast forward to today. Argentina had already defaulted in 2020 and this week interest rates rose in the country to 118%. I suspect that counts as ‘disorderly’ even under Lagarde conditions. The catalyst for the spike was a local election where the overwhelming winner wanted to drop the Peso altogether and adopt the USD which would result in total Peso collapse.

In El Salvador, you will recall, they adopted bitcoin rather than the USD. The story, which we do not get told, is rather different there. JP Morgan upgraded El Salvador’s debt this week on the back of stellar economic growth figures, 9% in the recent quarter.

The IMF was hugely against the adoption of bitcoin in El Salvador and worked incredibly hard to undermine the project (and continue to do so). El Salvador is a poor country. There is an awful long way to go and it would be a stretch to say that bitcoin is widely used. Should their geothermal mining get underway though they will continue to gain momentum with genuine economic activity that utilises their natural resources.

Paradoxically, bitcoin is more popular in Argentina than it is in El Salvador. The people there need it, their currency is collapsing. Bitcoin just hit all-time highs against the Peso. The fiscal discipline that bitcoin forced on El Salvador means the people need it less.

YTD returns against the weaker currencies like the Peso, Ruble and Turkish Lira speak for themselves; you might say the time period is selective, were it not for the all time highs bitcoin is reaching against these currencies. Bitcoin is adopted first where it is needed most. Once adoption happens, there will be no going back.

Paypal Coin

Those with long memories might recall WikiLeaks being cut off from banking after they had embarrassed the American government with some rather spectacular leaked cables. The most serious leaks came in April 2010; by December that year all the WikiLeaks bank accounts were gone; including their Swiss bank account.

In a nod to the current day administrative pain of dealing with a bank, the Swiss group concerned said:

“The Australian citizen provided false information regarding his place of residence during the account opening process.”

Another way of saying “America called”.

WikiLeaks' last fundraising method was PayPal and that account was closed in June 2011. It did very well to survive as long as it did. WikiLeaks were then forced to use an unknown payment method called bitcoin, the last man standing. Bitcoin bounced around that year between $2 and $30; WikiLeaks collected the coins and time did its work. The US Government had done them a huge favour.

From the perspective of where we are today, the WikiLeaks activity probably set bitcoin adoption in the US back by about five years, perhaps longer. Not a single US department of government would utter the word. Perhaps it would be better if it hadn’t happened but the point of permissionless money is that it does exactly what it says. Everyone can use it whether you agree with their cause or not.

To this day they use bitcoin for donations. If you access the donations page from Australia, Europe or the USA you will see this:

If you access it from any other country, you will see this:

Make of that what you will.

Considering that, it takes a bit of chutzpah for PayPal to announce they have launched their own digital currency backed by the US Dollar. The PYUSD is available in America for transfer between accounts and shortly Venmo accounts. It will be 100% cash backed, making it significantly more compelling than a US bank account, which has a reserve requirement of 0%.

I imagine PYUSD will be tremendously successful. It will be easy to use, instantly redeemable for cash and blockable at the whim of the Government. Indeed, I feel certain that it could not have launched without USG approval.

One thing is certain though, it will not help those unfortunate people who happened to be chatting on the street the day Apache helicopter, call sign Crazy Horse, tore into view.

Euro-Trash

There is no greater insult to the German economy than “you are doing worse than Italy”. As the ultimate benchmark of sclerosis, Italy are the champions.

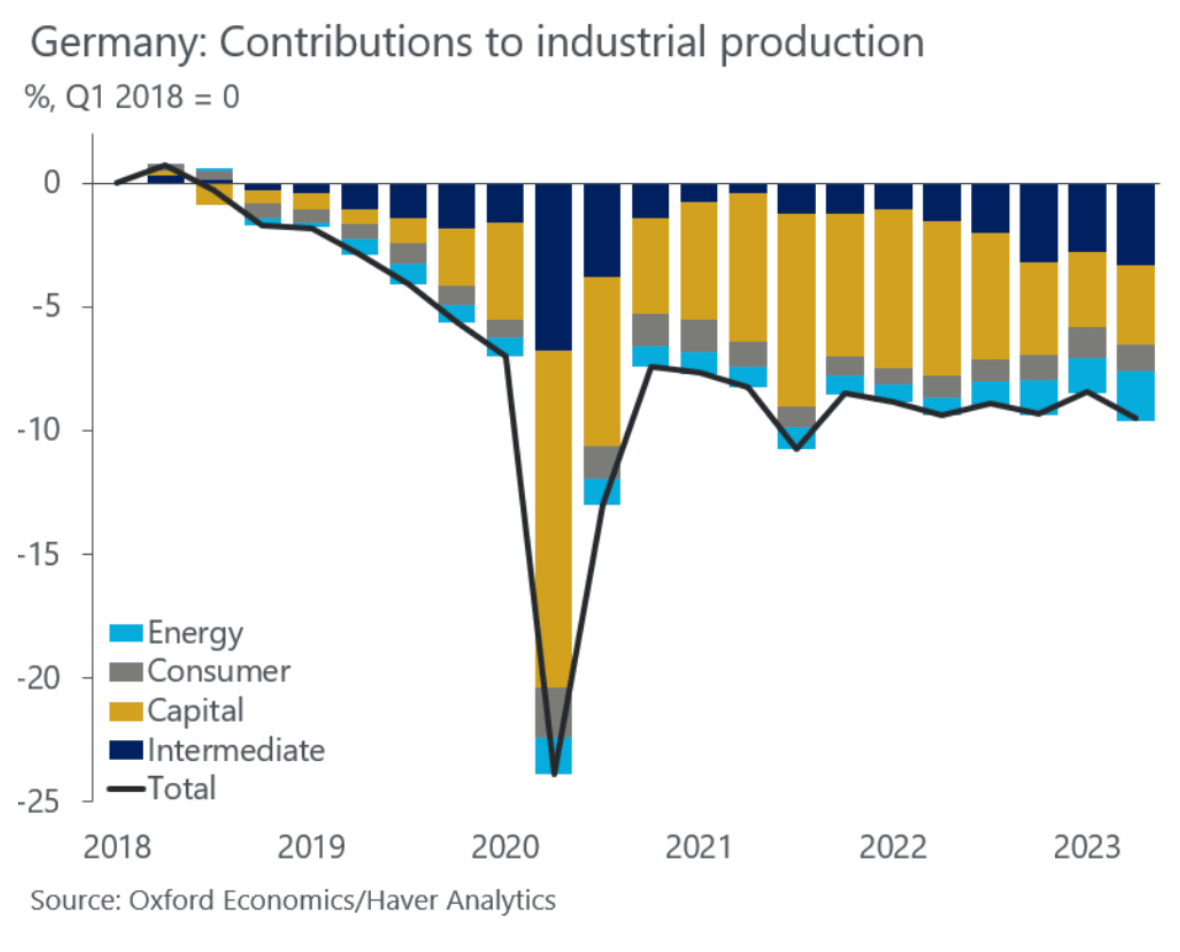

Germany is a mighty industrial producer. It represents 26% of all EU industrial output and 28% of its exports. Bad for Germany is bad for Europe.

The main issue of course is not lack of demand and certainly not lack of money. They lack power. Many industrial units remain turned off because Germany turned its back on nuclear. Perhaps they were right, but the consequences are brutal.

Since 2018 industrial production has dropped 10% which is enormous and the flow on effects must also be significant.

What’s more, private sector employment is still below pre-Covid levels. Two quarters of negative growth too. I’d call it a recession but they no longer exist, it's just a “slowdown”.

Another thing strikes me about the Germans. Perhaps it's just me but their cars don’t seem as good anymore. Not wishing to be snide but does anybody really want a BMW these days?

This advert reminds me of what I consider the peak German car moment. A stellar piece of advertising from Volkswagen.

Reflecting just how good those cars were, this Golf MK1 from 1983 is for sale today for $22,000. Top of the line Golf’s sold in Australia retailed for $4,000 that year. 5x isn’t bad for a car.

Either Golf’s are really good or money is really bad (both maybe).

Further information

Read our bitcoin news wrap-up on Livewire: Laying the foundations for increased flows into digital assets.

Our July 2023 report to investors can be found here.

If you are considering an investment in the Managed Fund, you can now apply using our online application form: