- MoneyBits

- Posts

- The many faces of Christine Lagarde

The many faces of Christine Lagarde

...she is pleased

📚️ PDF⏳️ 6 min 📖 6

Collateral

This evening, when you return home, someone is in your house. We will call her Jane.

Jane claims it is her house and has always been her house and decides not to let you in. You call the police, who arrive and check their records (which are limited regarding ownership). There is something that says you live there and you produce your ID.

Unfortunately, Jane also has ID, she has a litany of documents claiming ownership of the home. Title deeds (fake), utility bills (fake). Her children can be heard in the background in your living room.

It’s not obvious what happens next. Jane is in the house and possession matters. When the police arrived, she must have had access (how will you prove it was unlawful? She is waving your spare keys at the officer). You are the person arriving after the fact. You are the person claiming ownership. Jane is actually physically in the house, her children are watching your television.

Do the police evict the woman and her children and install you rightfully back where you should be? Unlikely.

There will be a process and it will take time.

Unlikely as this may seem it does happen. Not so much in Australia, but far more prevalent in Europe. The point being, that when it comes to physical property it is very hard (and time consuming) to prove ownership. Much of the legal system and financial regulation is designed to do exactly that.

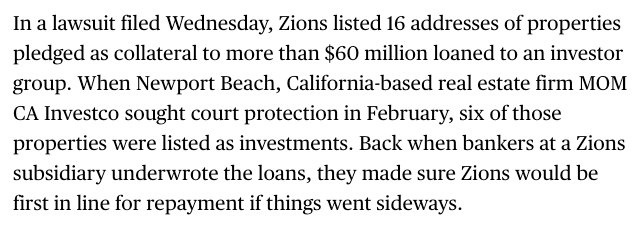

Difficulties with the ownership issue are far more prevalent in lending markets. The American market wobbled late last week on the back of two regional banks reporting some bad loans (very bad in fact).

In effect, the borrower has allegedly pledged the collateral twice (perhaps more). Now they have gone belly up and the bank has called the loan only to find that Jane is in the house with her children.

The issue of collateral is very real in banking because it is difficult to prevent this kind of fraud. In normal circumstances one can look up quite simply if a property is mortgaged, but that assumes the borrower is playing by the rules.

It is for this reason that the best collateral would enable the lender to verify that they are the sole beneficiary of the collateral. That is exactly what bitcoin does. Once a bank is given the private keys by the client, there is no way for any other person to physically claim the collateral. They could make a legal claim but possession 100% remains with the holder of the private keys. You cannot squat on a bitcoin, you cannot transfer or pledge it more than once.

This is exactly the reason that I believe it will be cheaper to borrow against bitcoin than anything else in the next 10 years. For a long time bitcoin-backed loans had 15%+ interest rates. Now you can have them for less than 5% and I expect that to fall further. It is pure collateral in a way that almost nothing else can claim to be.

Prediction markets

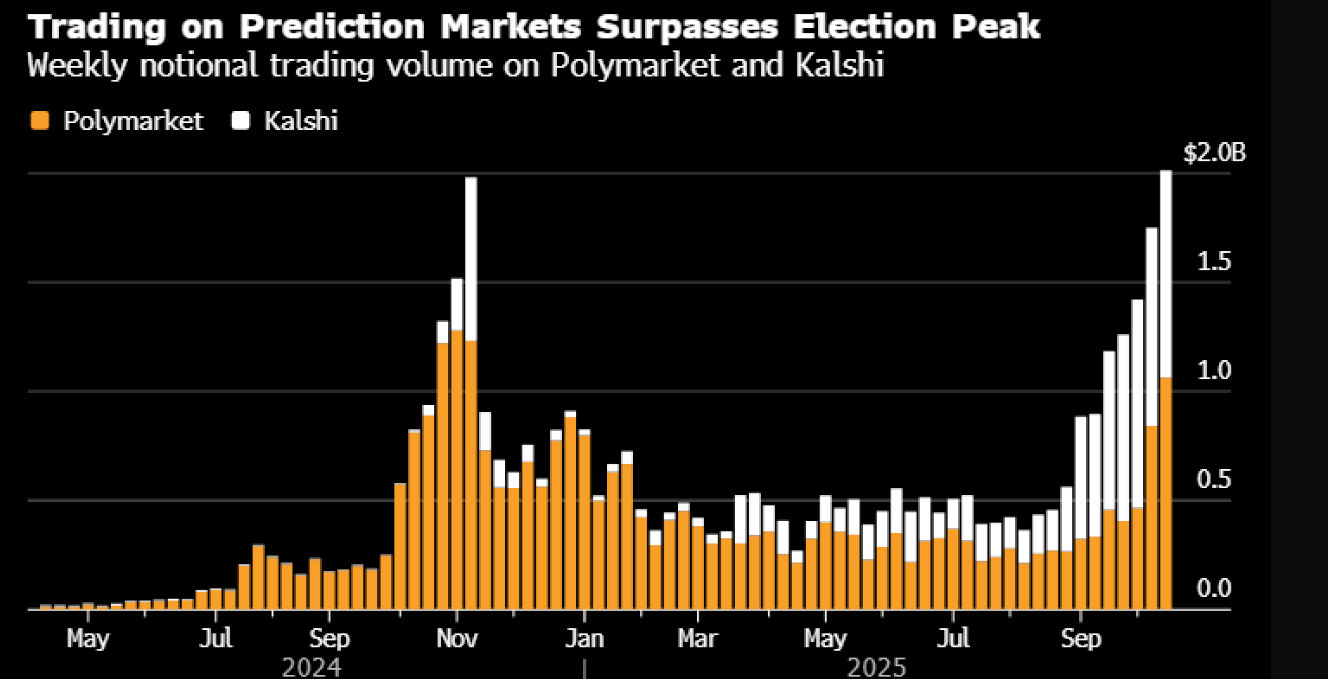

Prediction markets (which we covered in the U.S. election) are back to the peaks of November volume largely due to the new American football season. The interfaces are simple, the betting is simple and of course cryptocurrency deposits are the order of the day.

US$2 billion in a week is a lot. For comparison Australia’s largest tote pool had turnover A$4.2 billion on thoroughbred racing in the whole of 2024, a number that drops all the time. Not that it matters, we join elite company in banning the new products with our close friends in Cuba, Iran, North Korea and Russia (among many others I should add).

The timing here is interesting. At last week's shareholder meeting the TAB’s new CEO announced that the Australian Tote Pools will be merging soon (before June next year), declaring that it will be “Good for the industry, Good for punters and Good for the TAB”. As a (very) minor shareholder I certainly hope so, but I’m not hopeful.

Looking at Sunday’s NFL game.

POLYMARKET

TAB

No need to get too technical here but the margin taken in the market by Polymarket is 1%, by TAB, it’s 5%. Five times as expensive and banned in Australia because it's good for you?

The reality of new technology is that it unlocks value. Normally because of efficiencies, but that often means (or requires) that there is a loser. There are lots of reasons why the local provider is more expensive, one of them is the amount of tax they pay. In the case of the TAB it is undeniably huge and as a percentage of revenue would be among the highest of any company in Australia.

Still, the product is the product and in America it’s ⅕ of the price. One might legitimately ask, how that is sustainable?

One month to go

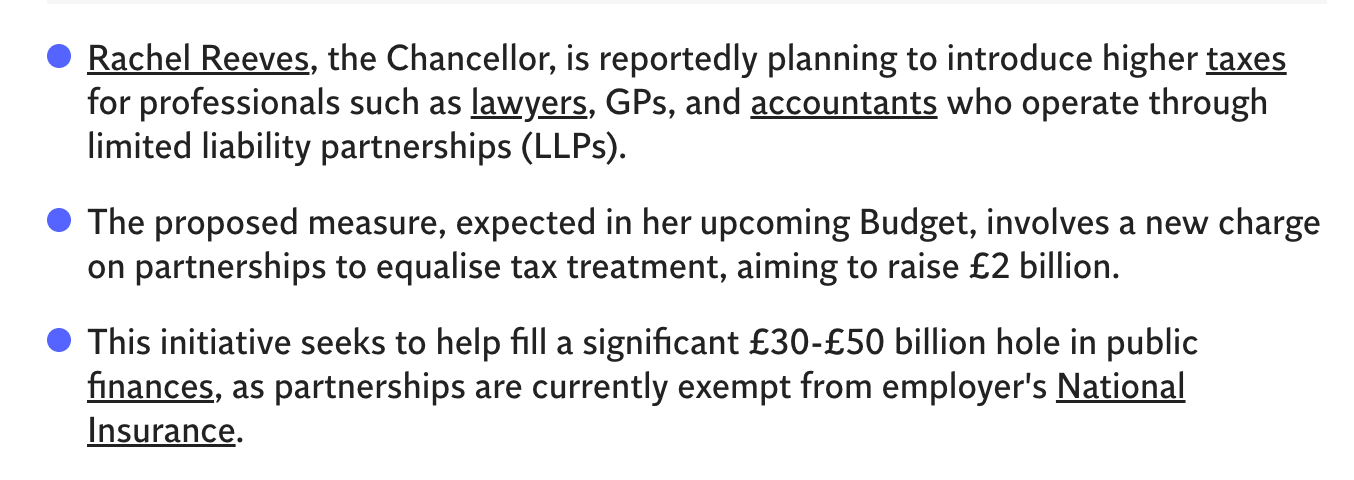

One month now until one of the most important UK budgets in peace time history. The issues are significant with a £30 billion gap between receipts and spending (1% of GDP). Most of the go-to fillers have already been raided. National insurance is up for everyone already, taxes are as high as they can go without receipts dropping off and all billionaires have successfully been chased away to the UAE.

The government also had an election pledge not to increase VAT (an already eye-watering 20%) so there isn’t much left to go at.

The chosen target? Doctors, lawyers, accountants. There won’t be much sympathy for them electorally which is probably why they are in the firing line. One of the foundation sources of the UK’s more recent success though is these people. In the 80’s and 90’s London was the place to do deals because the Magic Circle law forms were the best. The accountants were the most innovative and capital was drawn to London because of the non-dom rules. In short lots of very clever people and very rich people mingled in the City and did stuff. If you were building a country you might actually target having lots of clever and rich people doing stuff, you might even dare to celebrate it.

Gradually though, the UK government is creeping down the value chain. The people who wanted the work done have been scared away, their capital has left with them. Now those that actually did the work are left with the bill.

America’s Ambassador to the UK has some better ideas this week.

In the madness of the current UK policy settings the response to this in the upcoming budget is that the government plans to cut the rate of VAT on energy bills from 5% to 0%. Thereby cutting bills 5%. No acknowledgement at all that supply is the issue; just another stupid giveaway that makes the hole deeper.

And for what? For this.

Nobody uses it

“Nobody uses bitcoin”. But honestly, how would you know?

If you are reading this you most likely live in one of the richest countries in the world. You are likely moderately subjugated by a benign government (most of the time) which takes only 45% of your money. You enjoy a robust financial system. Your Australian or US dollars aren’t going to be confiscated anytime soon and it's unlikely their value will fluctuate that much on a daily basis. Over the course of a decade their value halves, and you can manage that (by just holding hard assets).

This lady, Roya Mahboob, is from Afghanistan and runs the Digital Citizen Fund. Since the return of the Taliban, most women in Afghanistan have been frozen out of the financial system, they are not permitted to open bank accounts etc. and cannot work. In an interview this week she explained the role of bitcoin in overcoming the mass debanking of women in the country.

Afghanistan, one of the most adversarial environments one could find. They use bitcoin. This email from Satoshi Nakamoto explains why.

Peer to Peer networks do survive in such environments. Tor and Gnutella, which most people have never heard of or used, continue to operate successfully some 16 years after his email. As does Bitcoin.

Euro-Trash

I am struck by something about Agent Lagarde. The nuance in the language used by the ECB is often repeated, everything is a compliment but, by degrees. We can discern something from the degree of compliment. Much like picking through the verbiage of the FOMC minutes.

If Christine genuinely likes you, she is “delighted” and you are a “good friend”. This is reserved only for those she is genuinely close to. I have seen it used for Draghi, Yellen and very few others. It is the hen’s teeth of Lagardisms.

Next in line. This time you are “a friend”. Still delighted but not a good friend. The smile in this case is less genuine. Nonetheless, if this ever happens to you, I would consider everything is good but you won’t be having Christmas dinner chez Lagarde.

“Pleased”. If Christine is “pleased”, she is anything but. At the time of this meeting, Egypt's economic reforms were not going as well as the IMF had hoped. Nonetheless, the photo shows that Christine is engaged in the meeting.

Finally we have this. “Pleasure”. This week it was Jim Chalmers turn to be withered by the ‘compliment’. Apparently, the discussion about geopolitical developments was “good”. The sort of thing a teacher writes on your homework.

I put together this handy ready reckoner for those of you who might meet Christine in future so you can immediately interpret her body language. The Jim Chalmers meeting was one of those rare occasions where Christine got it right.

Further Information

Our September 2025 report to investors can be found here.