- MoneyBits

- Posts

- The United Kingdom

The United Kingdom

.....is struggling

📚️ PDF⏳️ 6 min 📖 7

Vanguard

Back in December 2023 we covered that Vanguard was one of the few large fund managers who had not submitted a Bitcoin ETF application.

I was rather supportive of their view at the time: “Even so, Vanguard are sticking to their knitting and not pretending to know what they don’t know. In my estimation that makes them a good fund manager and not a bad one.”

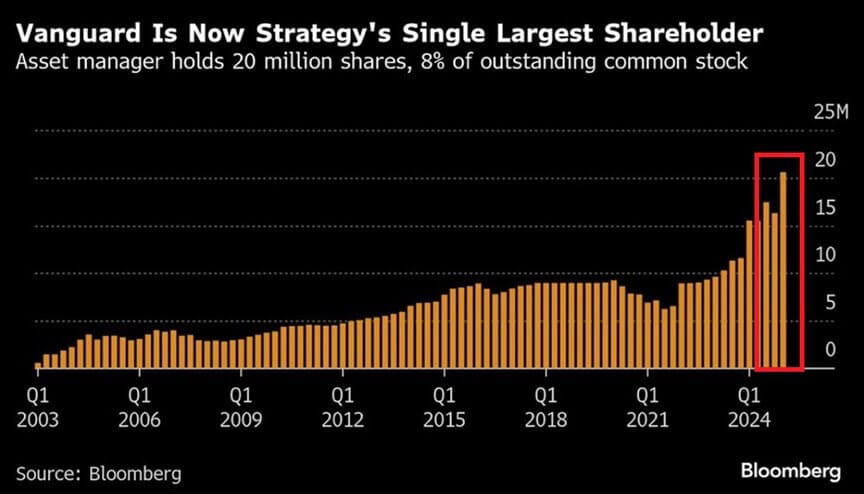

Today, they are the largest single holder of Strategy (formerly MicroStrategy), the leveraged holder of BTC. It’s amusing really because MSTR is much more risky than bitcoin. The fact is that Vanguard are now required to buy the stock because it entered the S&P500 so all their trackers are forced to participate. In this case the market has spoken louder than they have.

They must wonder though. When you look at BlackRock their Bitcoin ETF is now their single most profitable ETF product. Despite having lower AUM than their index trackers, the fees are higher.

So, the most profitable product of the world's largest asset manager is Bitcoin. When Larry Fink goes to the White House, when he takes calls from Senators about donations to campaigns, what will he say?

Politicians dance to the music of money. Now; the money is us.

UK

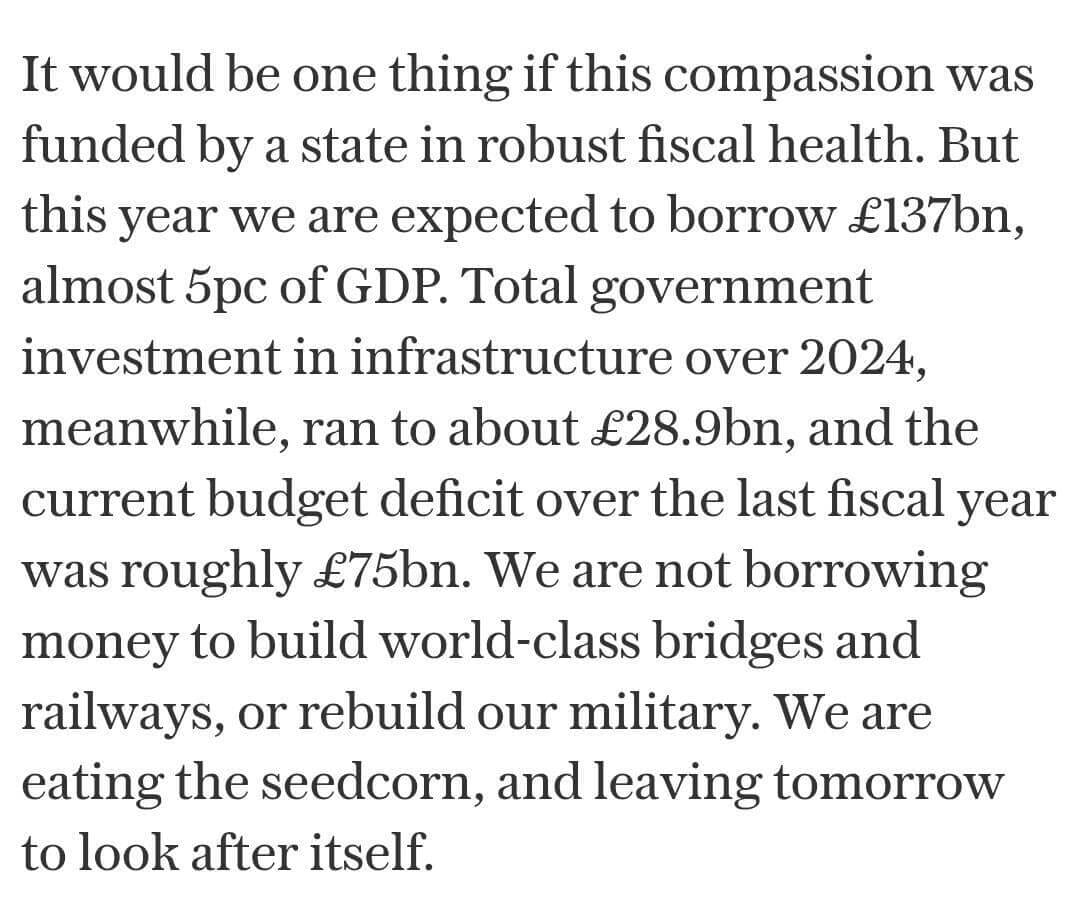

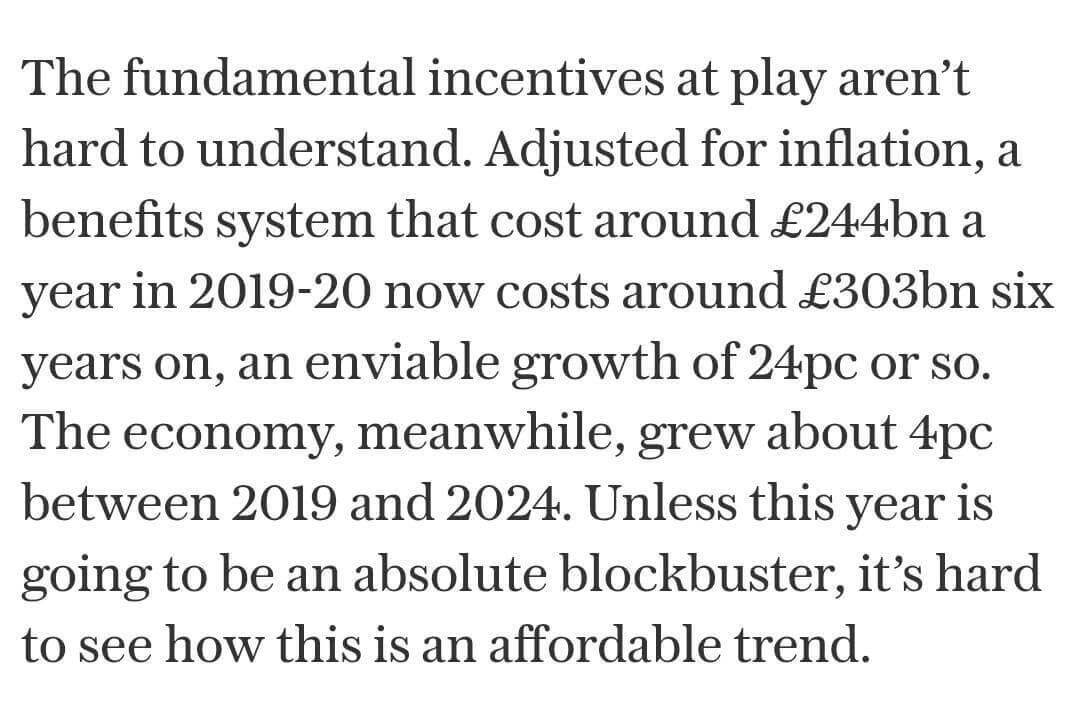

There isn’t much wrong in the UK. No recession, no impediment or excuse really as far the business cycle is concerned. The 5% deficit is simply a structural one. The overwhelming majority of that imbalance is now spent on benefits of one kind or another.

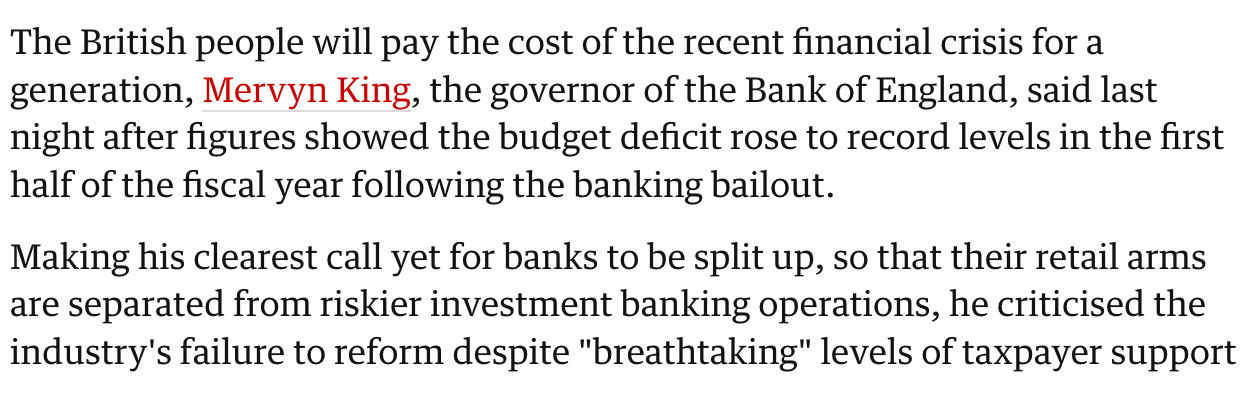

The stats are shocking, but the most depressing is that the UK has only experienced 4% growth (in total) between 2019 and 2024. Obviously we had major disruption in that period but the truth is the party ended in the UK during the banking collapse of 2008/9. The UK did not recover. The massive net wealth transfer from everyone to the banking system will go down in history. I recall at the time Mervyn King, who was governor of the Bank of England, predicted that it would take a generation to recover from the banking bailout. This extract is now 15 years old and still true.

That breathtaking level of support was the thing that gave birth to Bitcoin. In the very first bitcoin block Satoshi Nakamoto embedded the headline “Chancellor on the Brink of Second Bailout”.

Mervyn King has been proved absolutely right and we still have a decade of that generation to run. Matters are rather worse though because the government’s attempts to cut the benefits bill have been largely killed off by their own backbenchers. The simple game of incentives is that so many people now receive them that the only way to win an election is to keep giving them out.

It’s one of the reasons that the UK has an issue attracting capital these days. Nobody wants to list their company in the UK because the regulatory burden is so enormous. How did it come to this? London’s once-prized exchange raises only £160 million in six months - an embarrassingly low figure. The Hong Kong exchange raised 65x the LSE in that period. What’s more, if the government would let them, their second biggest company Shell Oil would leave for New York in a heartbeat. That discussion is ongoing.

The reasons are many, including an expatriate workforce that no longer sees London as attractive. Next is the enormous and rising cost of employing people in the UK. Then energy costs, the UK has amongst the highest per-unit energy costs anywhere in the world. Looking forward, the tax rate has to rise for the reasons outlined above. In the risk assessment then of which exchange to list on, London would have to look deeply unattractive at the moment. This is particularly true when the decision makers in these discussions are likely going to be non-domiciled, higher-rate taxpayers.

The UK took a similarly aggressive approach to Bitcoin regulation. Much like Europe, it went so far that it was almost impossible to run a business in this sector because the compliance cost was so high. The ‘travel rule’ for example required businesses to report any transfer and keep specific records for amounts over $1,000. It was designed to “stop criminals”. Criminals can read the legislation too though. So of course it immediately results in only honest brokers complying and spending the money to comply. It was as monumentally stupid as the changes to the non-domicile rule, which has completely wrecked London as a financial centre.

Still, the UK Chancellor this week faced the wind and vowed; “to lift 'boot on the neck' off business”.

Sadly, the stats don’t lie. The damage is done.

On Regulation

I had cause to look through the accounts of a small listed company in the UK this week. Capital and Regional, owners of out-of-town shopping centres. They delisted in 2024 after the majority shareholder sought to bring ‘greater efficiency to its capital allocation’.

That is the major impact of excessive regulation, it destroys capital efficiency. That is why the returns on the UK stock market have been so diabolical compared to everywhere but the EU. Of course, no investor given a choice deploys capital into an inefficient market.

Capital and Regional made £3m in profit in 2023. They had 34 staff centrally and another 40 or so at their shopping centres. I found their final set of accounts shocking. The Annual Report itself was 260 pages long, 46 of those pages are devoted to ESG. Consider that the cost of putting that report together would be huge. The audit fee alone exceeded 12% of the company's net profit.

I am not deriding the merits of these events or the importance to the participants. However, if you want people to list companies in London they will of course have to consider the cost of these disclosures and the cost of attending celebratory events like these so they can actually say something on the topic.

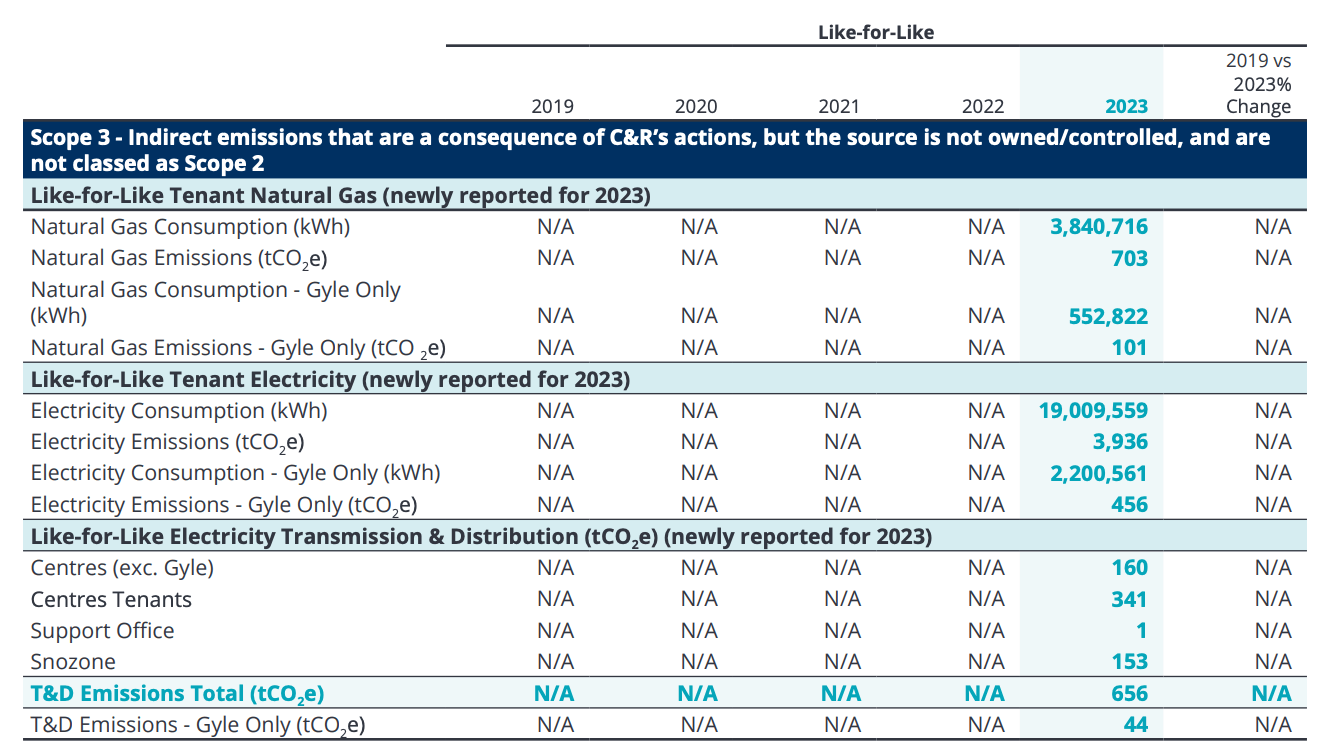

Then there are no less than ten pages of ‘Streamlined Energy and Carbon Reporting’. I have included an extract of one of them which sets out the company’s “indirect emissions”. Introduced in 2023, these disclosures require a company to estimate (guess) their downstream emissions of their activities. Frankly, they are bizarre. They mean absolutely nothing and I dread the thought of having to put them together. Not only the cost of doing so, but of course the cost of having that random spreadsheet audited. An entire cottage industry has sprung up in the UK that invents these numbers for companies, for a fee.

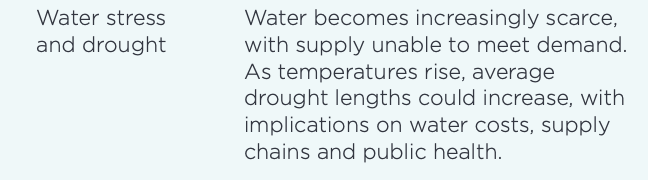

When I finally made it to the end of the ESG section, I was looking forward to the Profit and Loss Account. The bit shareholders actually care about, but no such thing……the next section was “Task Force on Climate-related Financial Disclosures”. Another 11 pages of total insanity.

The company had spent some time discussing their strategy if the UK runs out of water. I have no doubt that it would be an issue but if your staff and customers are all dead presumably it wouldn’t matter that much. There is relevance to the discussion about water security but it is not the job of non-experts in the real estate industry to do it. That they are legally mandated to do so in the UK is ridiculous.

How is it possible that the United Arab Emirates, which has no water, has an annual GDP/capita which now exceeds that of the UK? How is it possible that the UAE grows at 6% per year while the UK grows at less than 1%?

Why does nobody want to list a company in London?

The Annual Report of a small and once quite successful listed company in the UK tells us the answer.

Euro-Trash

This is the third progress report on the Digital Euro. It happens to be the most interesting too. A lot of discussion surrounds something called the “Holding Limit”. Essentially, the maximum amount of Digital Euros that any individual or entity can hold.

Fascinating on a number of levels because the Digital Euro is meant to replicate cash, where one can in theory hold as much as you want. The issue is a critical one. The Digital Euro will be a liability of the European Central Bank (in the same way physical cash is). Normal Euros in your bank account are a liability of your own bank, say Credit Agricole or Deutsche Bank. The ECB fears a situation where everyone simply converts to the asset with zero credit risk (the digital euro).

In the UK when this happened in 2008, everyone had to join queues and withdraw physical cash but with a digital version it could happen in 20 minutes. Silicon Valley Bank being a prime example. It collapsed in hours because everyone logged on and withdrew all their money. Digital brings speed, and fast is bad for bank runs.

The point of a central bank is as the lender of last resort. It can never legally go bankrupt. That immediately makes Digital Euros better than Euros themselves. In times of crisis everyone will rush into Digital Euros and this could stress out (or indeed bankrupt) many of Europe’s banks.

It is a fine line for the ECB to walk because they need to manage this without revealing the reason it's an issue. They know it too, they are being forced by the market to create a monster that could destroy them. The Holding Limit, when it is finally revealed, will tell us just how much confidence they have in the Euro. There was a very detailed discussion on this late last year for those interested.

I have changed my mind about digital currencies. Perhaps they shine a very bright light on their fractional reserve cousins. Digital Euros will unequivocally be more valuable than Euros themselves.

Further Information

Our June 2025 report to investors can be found here.