- MoneyBits

- Posts

- An unrestrained demon

An unrestrained demon

The dollar milkshake, a dramatic reversal, nutrient-dense choices and Microsoft Nuclear.

📚️ PDF ⏳️ 6 min 📖 7

Milkshake

You knew the US dollar was doing well; I bet you didn’t know it was this impressive.

Every single currency in the world is down in the last decade against the USD. One theory explaining this is the dollar milkshake. The video is four years old but it got a lot right. With US rates now relatively high it’s attractive to hold them and get paid nearly 5% on US treasuries. This attracts capital, pushing the USD up and making the trade even more attractive.

Standouts on the chart are the Japanese Yen, down 34%. British Pound, down 25%, Euro, down 22%. Even the Swiss Franc is down. Not commonly a loser long term and sad reflection on the state of Swiss banking.

The original chart didn’t include Bitcoin, helpfully I added it for you in the bottom right corner. +21,369% over the decade.

Probably nothing.

Recession

The downside when bonds start paying big rates of interest, everyone else has to do the same. As a result, personal interest payments in the US have spiked. In July this year they hit $506 billion for the month.

It’s an incredible number. $1,500 per month for every American and that excludes mortgage interest payments. I found this so unlikely that I checked the source data from the Federal Reserve.

There are 162 million Americans who work, so it’s $3,000 in interest per month for every one of them.

I making a few predictions off the back of this

America is already in recession. No way the consumer can tolerate these rates

The reversal in 2024 will be dramatic. There will be both political pressure in an election year and enormous demand from the American people for lower rates.

They should have stopped and waited at 4.5%.

A unrestrained demon

This cartoon from 1889 heralded the arrival of electricity as “an unrestrained demon”. It was prompted by a Western Union lineman who was high up in the tangle of overhead electrical wires in Manhattan. As the lunchtime crowd wandered by he grabbed a line that, unknown to him, had been shorted many blocks away with a high-voltage AC line. The jolt entered through his bare right hand and exited his left steel studded climbing boot. He was killed instantly, his body falling into the tangle of wire, sparking, burning, and smouldering for the better part of an hour above a horrified crowd.

It was an unfortunate start for a new technology that would go on to transform the whole world despite the best efforts of cartoons like this to terrify people. Still, even today electricity kills 1,000 people in the US (the number is much lower per population in Australia at 20). It is dangerous, we accept the risk and get better at managing it and that’s pretty much it.

Risk perceptions are never very rational though. My children are afraid of dragons but they are not afraid to cross the road despite my best efforts to alert them to the biggest danger in their lives.

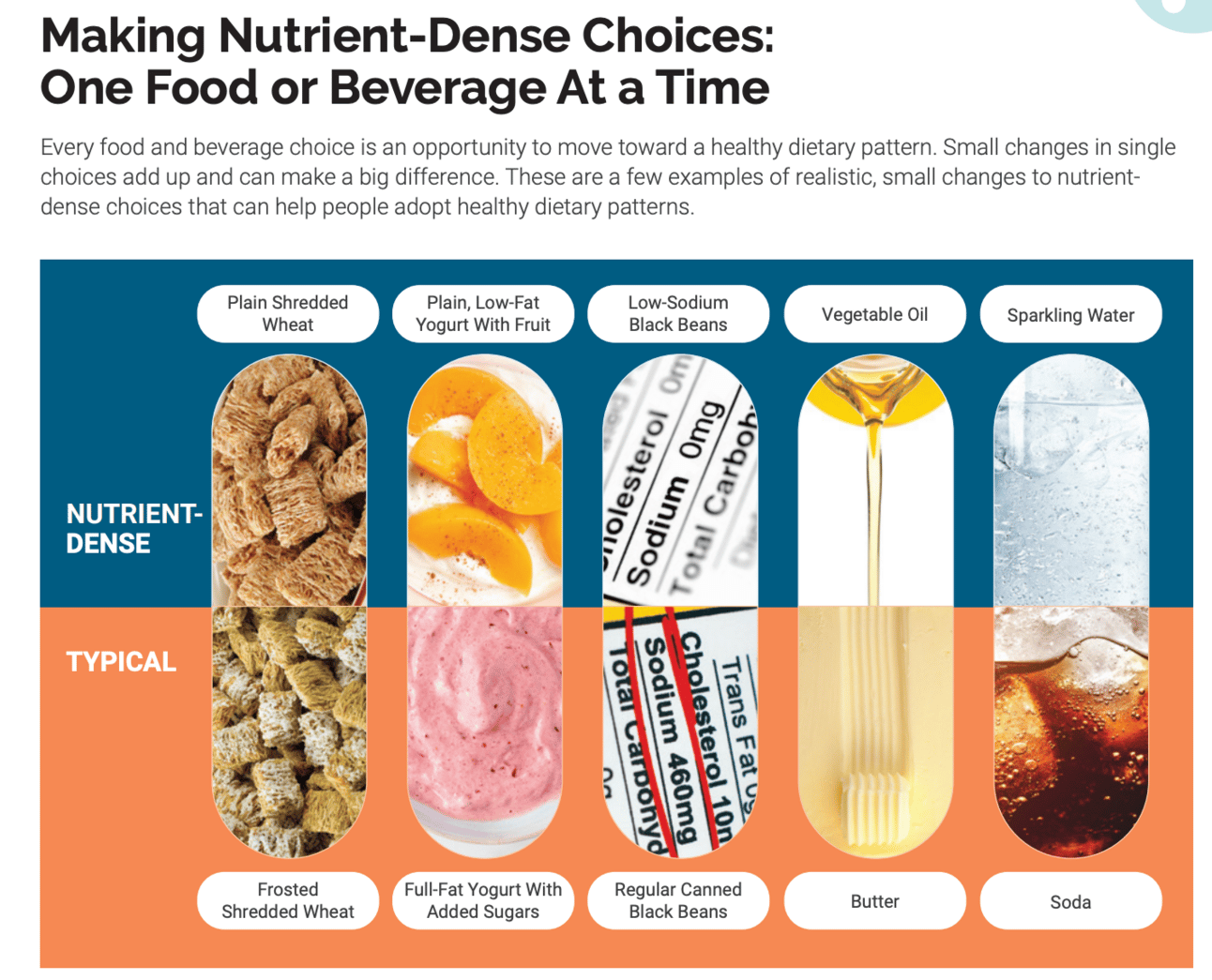

The best example I have ever found though is food. Most people actually believe the government's advice on what to eat. Here’s an example where the US government makes some “healthy recommendations”.

The nutrient dense version, in every case, is a processed food that does not naturally occur (and of course involves some private company that does the processing). Even the water is sparkling.

Vegetable oil over butter? Extraordinary.

Most people are happy with the government’s advice, even though it is so deeply perverted by lobbying and industry money.

I can think of no better example of ‘do your own research’ than food. It kills more people than anything else.

It applies equally to opinions on new technology and investing. What the government ‘says’ is generally what incumbent industries have paid them to say. It will, in most cases, have no bearing on the facts. That 70%+ of American adults are obese should be proof enough that this is true. This is their own report.

“Eat vegetable oil, not butter”, of course, because it is massively profitable to sell industrial sludge oil to people as healthy. 100 years ago “electricity was an unrestrained demon”; so said the whale oil industry. Today, “Bitcoin is too volatile”; banks and incumbent financial services entities say so and they pay the government to say the same thing.

Personally on hearing these things I:

Buy bitcoin.

Use butter, not industrial cancer sludge.

Turn on the aircon and dream of the day when I’ll own my own modular nuclear reactor so I can mine bitcoin while reading American actuarial life tables.

The full American guidelines on diet (sponsored by Kellogs) can be found here.

Microsoft Nuclear

Speaking of such things Microsoft had a very interesting job posting this week:

“Principal Program Manager, Nuclear Technology”, who will be responsible for maturing and implementing a global Small Modular Reactor (SMR) and microreactor energy strategy.”

What prompted this? OpenAI. Their demand for electricity is enormous thanks to the chips that crunch out the responses. It’s now pretty clear that AI has surpassed bitcoin in its energy use and Microsoft is getting on the front foot regarding the ESG consequences of that.

The power consumption of bitcoin is clearly something that is holding investment by some larger managers back. Despite the fact that the industry is nearly 60% renewable, far in excess of any other.

Modular nuclear is already in use by some of the largest bitcoin miners in the US, albeit in stealth mode. Microsoft is just a little bit more open about it and I doubt much happens around nuclear energy at Microsoft without Uncle Sam giving the nod.

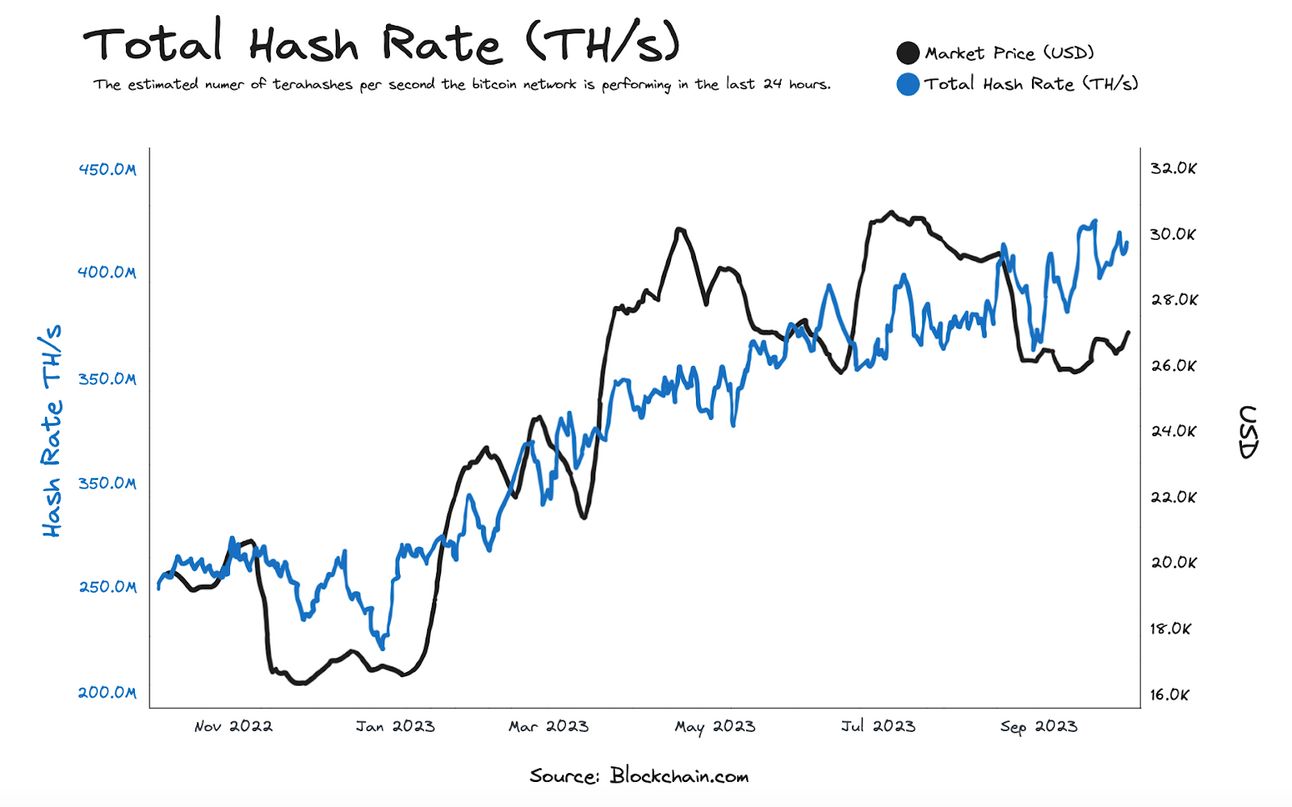

If we look at Bitcoin’s mining hash rate over the last 12 months it has nearly doubled. The newer mining machines are faster and more efficient but somebody somewhere has found a lot of cheap power and my guess is some of that is nuclear.

Euro-Trash

Happily, France has led Europe by launching and official certificate for “finfluencers”. Should you wish to shill your latest crypto-scam or financial ponzi you can now do so with the official backing of the Élysée Palace.

Seizing on the opportunity we have partnered with a Frenchman and will shortly be launching Diesel-Sub-Coin.

This new product will give you access to 75 year old submarine technology developed by France in the middle of the last century. We are aiming to raise A$50 billion. The money will be used to compensate France for the contract we cancelled a few years back. Apply here.

Elsewhere in Euroland, Chief Economist Philip Lane was presenting his “everyone agrees with me” slides. Professional forecasters all agree that in 5 years time, inflation will be 2%. It’s a curious time for Philip to make this prediction, his term ends in 2027 and his prediction will only be definitely wrong in 2028.

He also added this which rather suggests the ECB is done raising interest rates:

“Based on our current assessment, we consider that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target. Our future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary. We will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction.”

Further information

Read our bitcoin news wrap-up on Livewire: When money doesn't work, people stop working

Our September 2023 report to investors can be found here.

If you are considering an investment in the Managed Fund, you can now apply using our online application form: