- MoneyBits

- Posts

- Whatever you do, participate

Whatever you do, participate

Defying gravity, minor victories, floating into obsolescence and an interesting career.

📚️ PDF ⏳️ 6 min 📖 8

Upgrade

“the rally on El Salvador bonds almost defies gravity”.

So says Santander, which is quite something given the disastrous year bonds are having almost everywhere else.

In truth, the bonds still have a junk rating, but through bitcoin, El Salvador has found a way to put itself on the map globally, attract significant inbound investment and build a bitcoin mining industry based on its natural volcanic resources.

There is an entire ecosystem of vested interests rooting for El Salvador’s failure, not least the supposed saviour of struggling nations, the IMF.

Much still hangs in the balance. Will the mining industry take off? Will volcano bonds ever launch? Thus far, every time there has been doubt, El Salvador has delivered. They just need a little bit of momentum and it will be hard to stop; if that happens, a few other Latin American countries might follow suit.

Acceleration

In reviewing this chart you might draw the conclusion that wars and central banking are bad for inflation. The real acceleration also took off in the 1970s, at the end of the Gold Standard, but perhaps there is more to it.

It would be a simple matter to put a profoundly negative spin on this around money printing, endless war and all the rest of it. But it may well be that progress is accelerating generally. Technology began its huge acceleration in the early 1980s, followed by the internet, digital currencies, and more recently AI, which is an order of magnitude more accelerative than its predecessor technologies.

You could view it in one of two ways:

It’s a giant fraud of monetary dilution which is unfair and unjust - I will not participate.

There is a huge acceleration in everything; technology; money printing; progress generally - I must participate and am fortunate to live in such a profoundly advancing period for humanity.

It’s probably a bit of both, but just because fiat money is broken doesn’t stop anything, not progress, not the invention of new ways of exchanging value and certainly not the number of good opportunities that come up if you feel like grabbing them.

The graph is awful and simply says find another way but whatever you do, participate.

Accounting

It seems unlikely that the niche world of accounting standards could have much impact on asset prices. Corporate entities have been dissuaded from investing in bitcoin because of the bizarre accounting treatment it received.

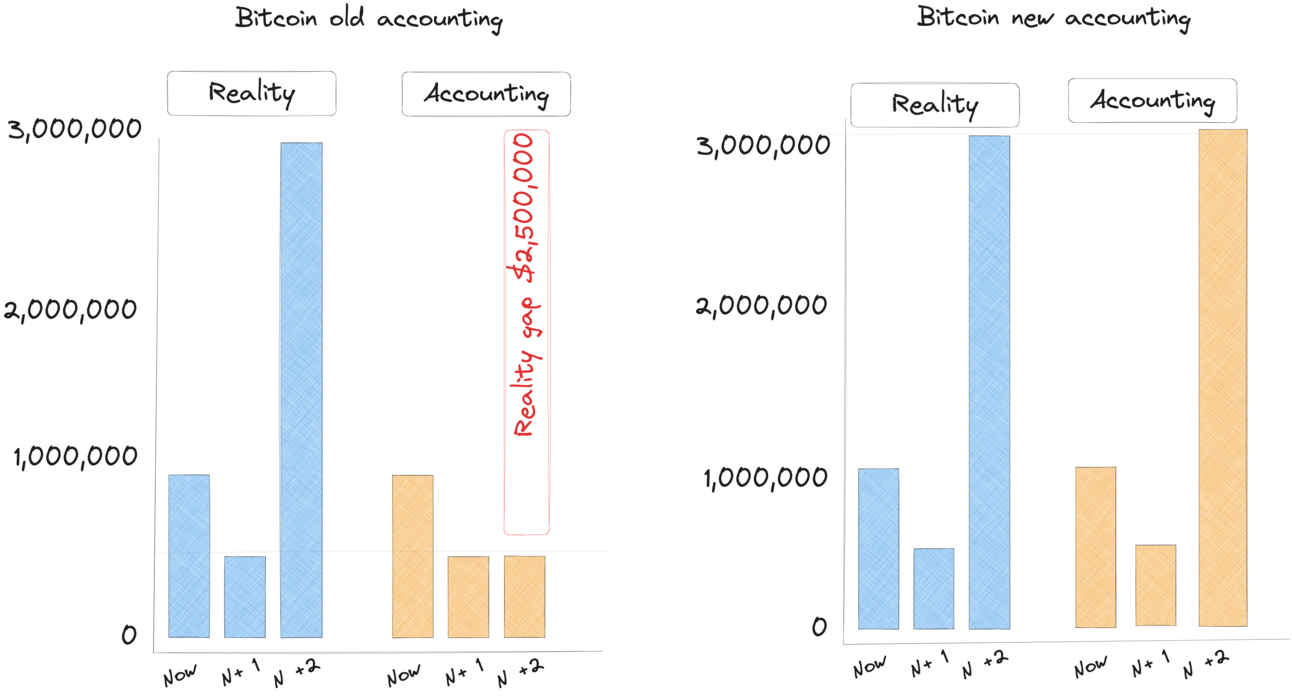

Assume a company buys $1m of bitcoin. The price then falls to $0.5m before rallying to $3m at a later point. Under previous rules, the company must always carry the bitcoin at $0.5m under a concept known as intangible asset accounting, which requires that once an asset is written down it can never be written back up. When the asset recovers to $3m that leaves a $2.5m gap between economic reality and what the balance sheet actually records.

There are good reasons for that treatment, particularly for things like goodwill, but it is crazy for something like bitcoin.

Under the new proposals, companies would write down to $0.5m and on recovery would take up the $2.5m gain on the balance sheet, as you would with any other liquid asset.

It is a minor technical victory for commonsense. We seem to be racking up the minor victories at the moment, which I consider both helpful and likely to compound over time.

Full details here for interested bean counters. US GAAP only at this stage and full publication expected before the end of the year.

Where is the money coming from

Do you see cutbacks? I don’t.

Perhaps the reason is in the chart, the United States will register its third largest budget deficit ever this year, exceeded only by the Covid years of 20/21.

It is very unusual to have what is considered full employment in the US at the same time as record deficits. The same is true to some extent in Australia, getting staff is hard but the government has the pedal to the metal on spending. Our 50 year old submarines will be ready in 10 years and the spending won’t stop until they float into obsolescence.

US GDP is about $23 trillion dollars. The deficit alone is some 9% of that. So when we hear that US GDP is ‘growing’ and the economy is ‘flying’ we ought to consider the sheer amount of money that the USG is pumping in there. The growth in the deficit itself since 2022 more than accounts for the growth in US GDP.

For context, Spain’s GDP is $1.5 trillion. 50 million people live there. $2 trillion is a lot of money.

Euro-Trash

I believe I have explained before that the primary role (indeed the only role) that the ECB has in European law is to keep inflation at 2%. Their utter and complete obsession with climate change continues though. I do not wish to diminish the importance of the climate, but I would very much rather it be left to people that understand climate rather than to people like Luis de Guindos, the Vice President of the ECB.

Senor De Guindos has had an interesting career, notably the few years he spent in the private sector.

“In 2006, de Guindos was appointed advisor for Lehman Brothers in Europe and director of its subsidiary bank in Spain and Portugal, where he remained until the collapse and declaration of bankruptcy of the latter in 2008. Subsequently, de Guindos became responsible for the finance division of Pricewaterhouse Coopers.”

Lehman Brothers and PwC (full disclosure; I worked for PwC too and enjoyed it).

He was educated at the deeply financially-focused CUNEF University in Madrid. You can go there and study finance, economics, maths or computer science. There is no science faculty – no climate expertise at all. It’s nearly impossible to imagine that this man has ever encountered any knowledge to do with the weather during either his time at university or during his private sector career, when he was running minor subsidiaries of about-to-be bankrupt institutions.

In his speech, he flexed his expertise to tell us how important solar and wind will be to Europe.

Europe this weekend had no wind. The spot electricity price in Germany went through the roof. The basic reality is that sometimes there is no wind and no sun.

I’m not suggesting at all that the climate is not important but I am saying that the people shilling these ‘new technologies’ have absolutely no idea what they are talking about. If there is one saving grace for Europe it might be the French.

Earlier this year their energy minister had this to say

“French nuclear power is “an absolute red line” and non-negotiable, Finance Minister Bruno Le Maire, following Franco-German disagreements over the role of nuclear energy in Europe.”

Bruno’s dad was the CEO of the highly successful French oil company, Total. He might have some idea about sources of energy then and how important they are.

Further information

Read our bitcoin news wrap-up on Livewire: Bitcoin industry news for August 2023.

Our August 2023 report to investors can be found here.

If you are considering an investment in the Managed Fund, you can now apply using our online application form: