- MoneyBits

- Posts

- Working with Katy

Working with Katy

...Australia's Elon Musk

📚️ PDF⏳️ 5 min 📖 6

Both ways

You cannot have it both ways. We talk all the time about the collapsing value of fiat currencies, so bitcoin touching an ‘all time high’ in the week is a purely nominal measure. We know this because in Turkey and Venezuela it has all time highs frequently because those currencies are in such steep rates of decline.

The true measure of bitcoin has to be against something much more stable. The best known example would be the stellar asset performer of the year, gold. As a thesis for the longer term we believe that bitcoin will continue to take market share from gold which has certainly not been true in 2025.

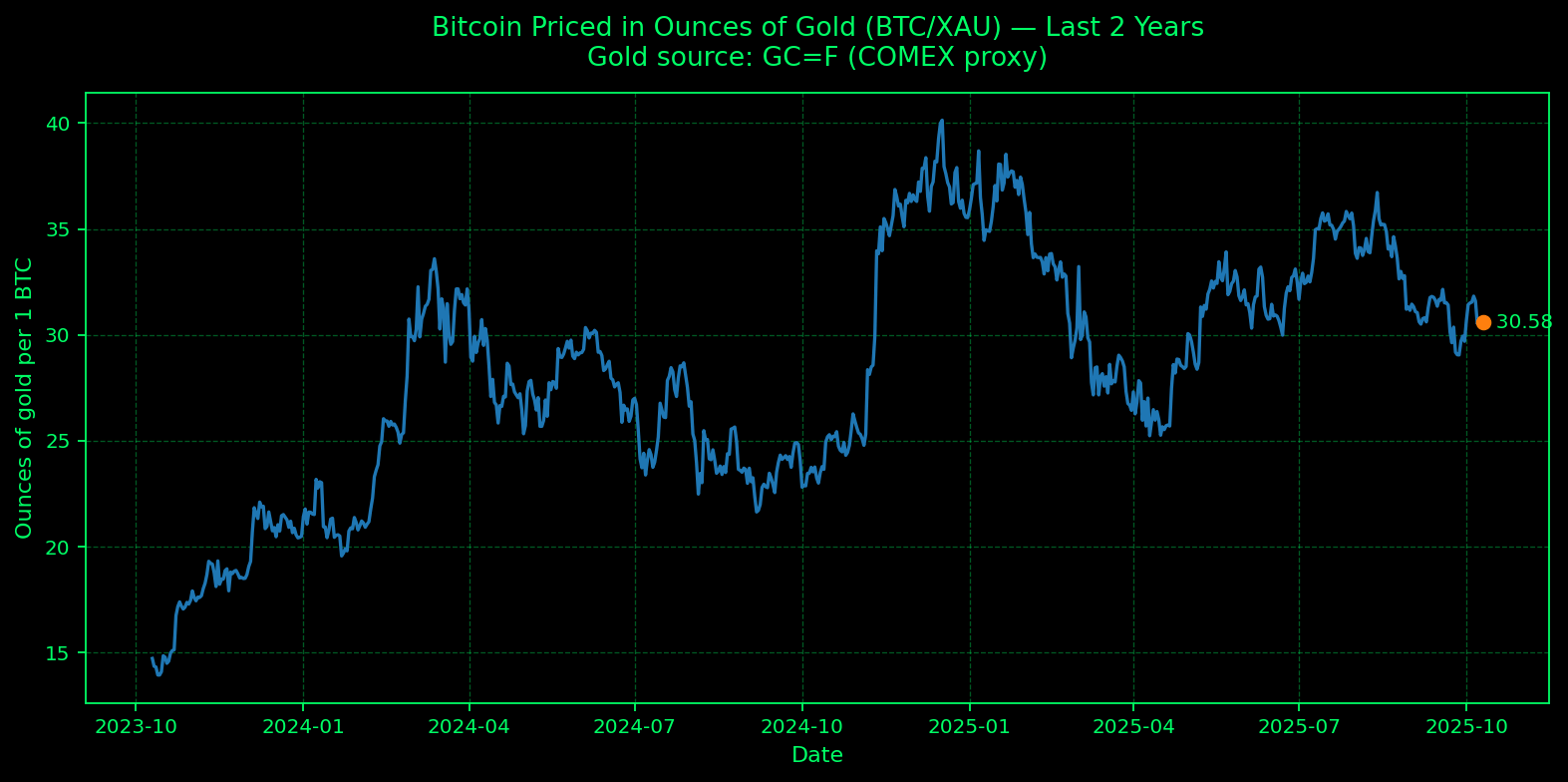

Looking at the last two years, we peaked at around 40 oz gold per bitcoin in late 2024 and have trended down on the back of gold's strength since.

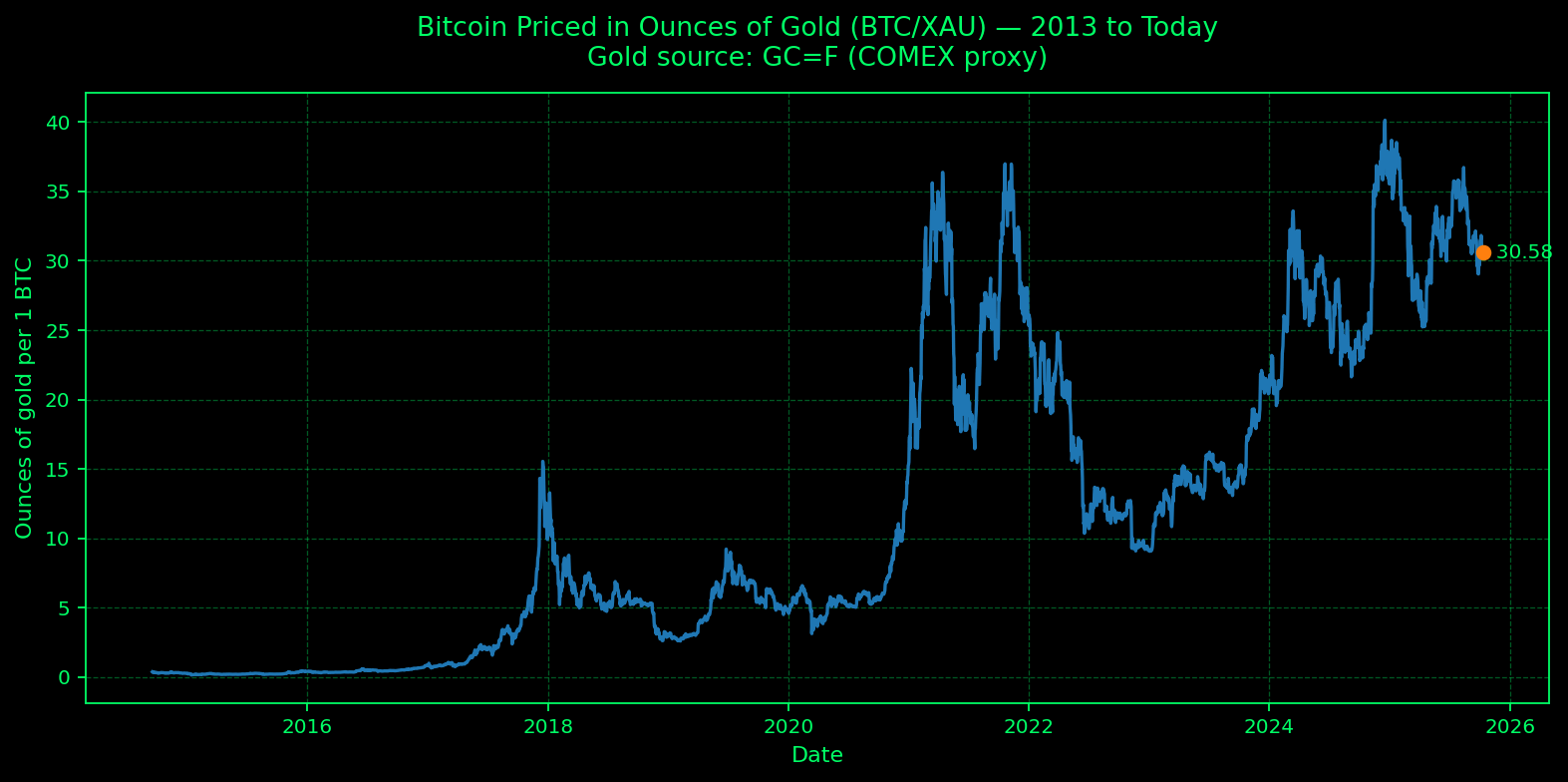

Over the longer term it's rather different, bitcoin absolutely eating gold.

One of the reasons that we think the longer trend continues is that the gold buying is really China. They are switching out of US Treasuries and into gold, a trend that cannot continue forever. As that trend slows and gold producers respond with increased supply we are likely to see its progress slow. More than that though, bitcoin’s rise is not a government decision. It rises because people (generally younger ones) choose to buy it. A far preferable position than having a single economic actor doing so.

Demographics and the digital age all favour bitcoin. Even so, it was not on any objective measure an all time high.

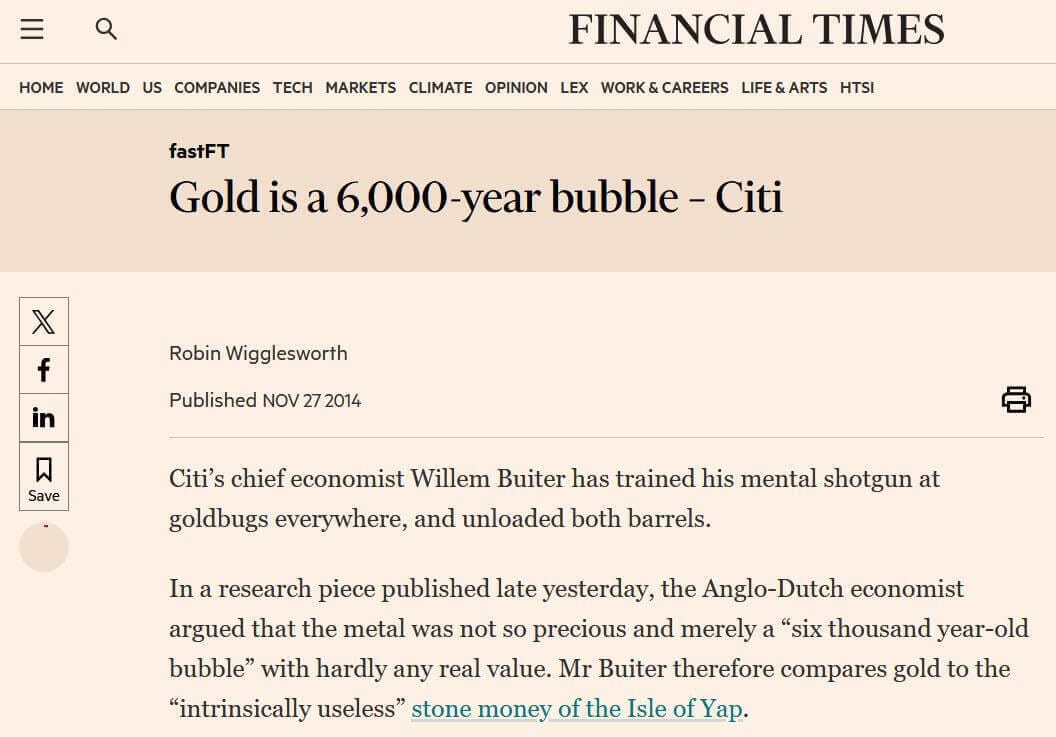

6,000 years

That was 2014, “a 6000 year bubble”.

The “everything is a bubble” crowd continue to amaze me and not because they are wrong. They are right. The disagreement comes from why they are correct. The bubble, over the longer term, is the measurement basis. No government ever has been able to resist debasing their currency and no government ever will.

It is exactly the reason that most people’s best investment ever is their house. They believe it's because the price of housing rose after they purchased it. They believe their timing was good and they are a genius real estate investor. Again, nominally correct. The real gains though occur through the mortgage liability which erodes beneath them. They made their money from being short the currency, not long the property.

It’s not that gold is in a 6,000 year bubble. It’s that the history of currency debasement is also that long. Here’s one from medieval England (1500’s). Here’s one from the reign of Cleopatra VII (51BC) and there are plenty more in between.

Gold just kept on being gold.

NSW

We increasingly discuss that the relative contribution of labour to the economy is collapsing. The road to universal basic income seems set.

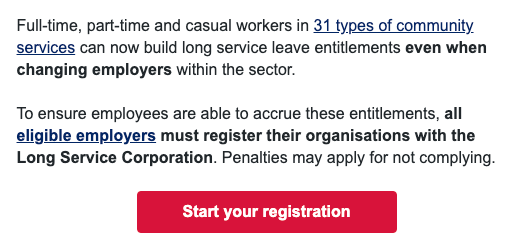

That is not suddenly going to happen though. There will be gradual creep and things will happen along the way. In this case, Long Service Leave is being offered for something other than long service. The original idea was that if you had had worked for the same employer for 10 years you received two months of paid leave.

LSL is unique to Australia and was originally for public servants from the United Kingdom. They would be granted extended leave from subjugating the natives to travel home (a three week voyage at minimum). Naturally, as the rest of Australia saw this happening they wanted it too, so 10 years service was extended into the private sector. Now everyone gets it.

From July this year the benefit was further extended to those working non-continuously in community services. Service is now portable to any employer (i.e. it needn’t be with the same employer). The categories are listed here. For example, if you provide “Social services empowering and developing social cohesion” (like I do), you would qualify for portable long service leave.

I’m not taking issue with the selected group. There is no doubt that it is a category that suffers from transient employers for a variety of reasons. I’m just pointing out the accelerating creep of benefits that involve not working. As of July, it's just those in community services but it will be extended to everyone over time. Then it won’t be 10 years, you will be able to take it whenever you want to. “Personal circumstances” mean I just have to go on holiday to Fiji for a week.

Overall, I consider this a good thing. It’s progress but it all contributes to making human labour less and less compelling and so there will be less and less demand for it. Perhaps we should simply be honest and set out that our objective is that we do not really want people to have to work.

Katy Gallagher

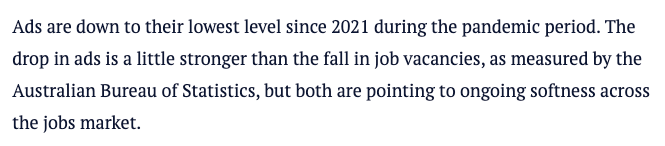

The harsh reality is that only 53,000 in 2024 were created outside of the Australian Government.

The assertion seems to be that if the RBA cuts interest rates it will help the jobs market. It might, but that is not the trend that is causing the difficulty in finding work. White collar roles in particular are being annihilated by artificial intelligence. Everyone seems terrified of admitting it, certainly in the big banks. In the real private sector, the one that operates without implicit government guarantee, the story is different. You can indeed deploy AI at scale to do many many things.

One example from this week is Google DeepMind CodeMender.

The software reviews code for potential bugs and security weaknesses. This is a huge and important role that currently employs elite-level developers who are paid millions of dollars. Those roles are history. The people involved are sufficiently talented that it won't matter, but these types of capabilities are cascading through the white collar market at all levels and yet there is silence.

Only two months ago the Australian Treasurer took to the Guardian to tell us everything is fine (reproduced here on his website).

“It is not beyond us to chart a responsible middle course on AI, which maximises the benefits and manages the risks.

Not by letting it rip, and not by turning back the clock and pretending none of this is happening, but by turning algorithms into opportunities for more Australians so they’re beneficiaries not victims of a rapid transformation which is gathering pace.”

Technology just moves way too fast for governments to meaningfully respond. His prescription for Australia dealing with this is as follows:

building confidence in AI to accelerate development and adoption in key sectors

investing in and encouraging upskilling and reskilling to support our workforce

helping to attract, streamline, speed‑up and coordinate investment in data infrastructure that’s in the national interest, in ways that are cost effective, sustainable and make the most of our advantages

promoting fair competition in global markets and building demand and capability locally to secure our influence in AI supply chains

working with Katy Gallagher to deliver safe and better public services using AI.

It's the usual tropes that mean nothing and who is Katy Gallagher? How will she defeat Sam Altman, Elon Musk and the team at Google Deep Mind?

Just an odd way for him to sign off. “We will invest, we will train and we will work with Katy Gallagher?”.

Much rests on her shoulders then.

Euro-Trash

More from Lagarde this week on what is effectively the ECB strategy to exploit perceived dollar weakness. Most interesting in that list (you would need to zoom in); “Rebuilding Europe’s hard power”. We discussed this some weeks ago regarding Germany’s leap in defence spending but there is no doubt it is a very real and very open policy position now.

Meanwhile, exactly when they need it most, the collapse of German industrial production continued in August. Down 4.3% in the month (adjusted for the holidays as well). It was entirely driven by the motor industry which fell 18.5% MoM in August.

Across the border in France, the new Prime Minister Sébastien Lecornu is now the old Prime Minister. He resigned after less than a month to become the shortest office holder in history, outdoing his immediate predecessor.

One French minister took to Twitter “je désespère de ce cirque”.

I’m rather enjoying the circus myself. Ever since the Euro began, France, Germany and everyone else involved has been less than truthful about what monetary union without fiscal union actually means. It means that we have a mess. A mess with good cheese, nice summer holidays and unhappy Germans.

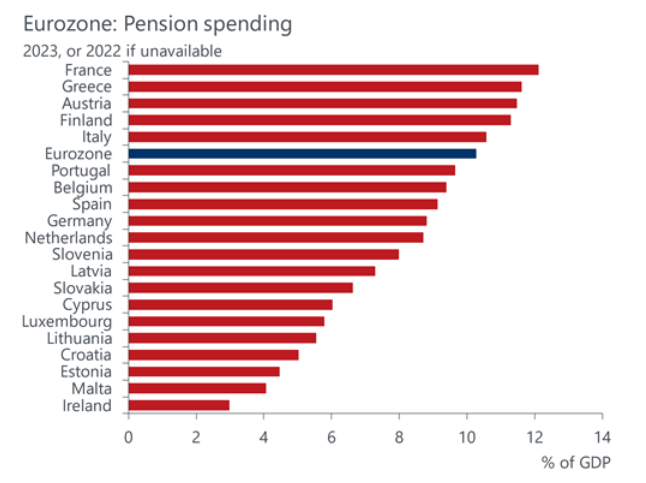

One example of the scale of the mess. 12% of French GDP goes on pensions. They have to cut this, but nobody wants to cut it or supports cutting it. This number is trending to be above 20% of GDP as we head to 2050.

Further Information

Our September 2025 report to investors can be found here.