- MoneyBits

- Posts

- China week

China week

...and other things

📚️ PDF⏳️ 4 min 📖 7

Vanguard (again)

December 2024. We are never doing it.

December 2025. We are doing it.

I was impressed when they held the line last December and said no.

Money talks though. Clients want the asset class, advisors want the asset class and Vanguard had no choice. We have had several months of ‘nobody wants bitcoin’ news. If that were really true, why is the BlackRock Bitcoin ETF the most successful ETF ever (in terms of first year flows)? Why has the second largest fund manager in the world (AUM: $9.3 trillion) just added it to its platform?

Not just Vanguard either, Bank of America Private Wealth also changed their minds this week. I’m not sure “recommending” is the right way to go about it. Even so they are suggesting 1-4% to their clients, of which there are 70 million. The Bank will begin covering the big bitcoin ETFs from January 5th 2026.

One trend

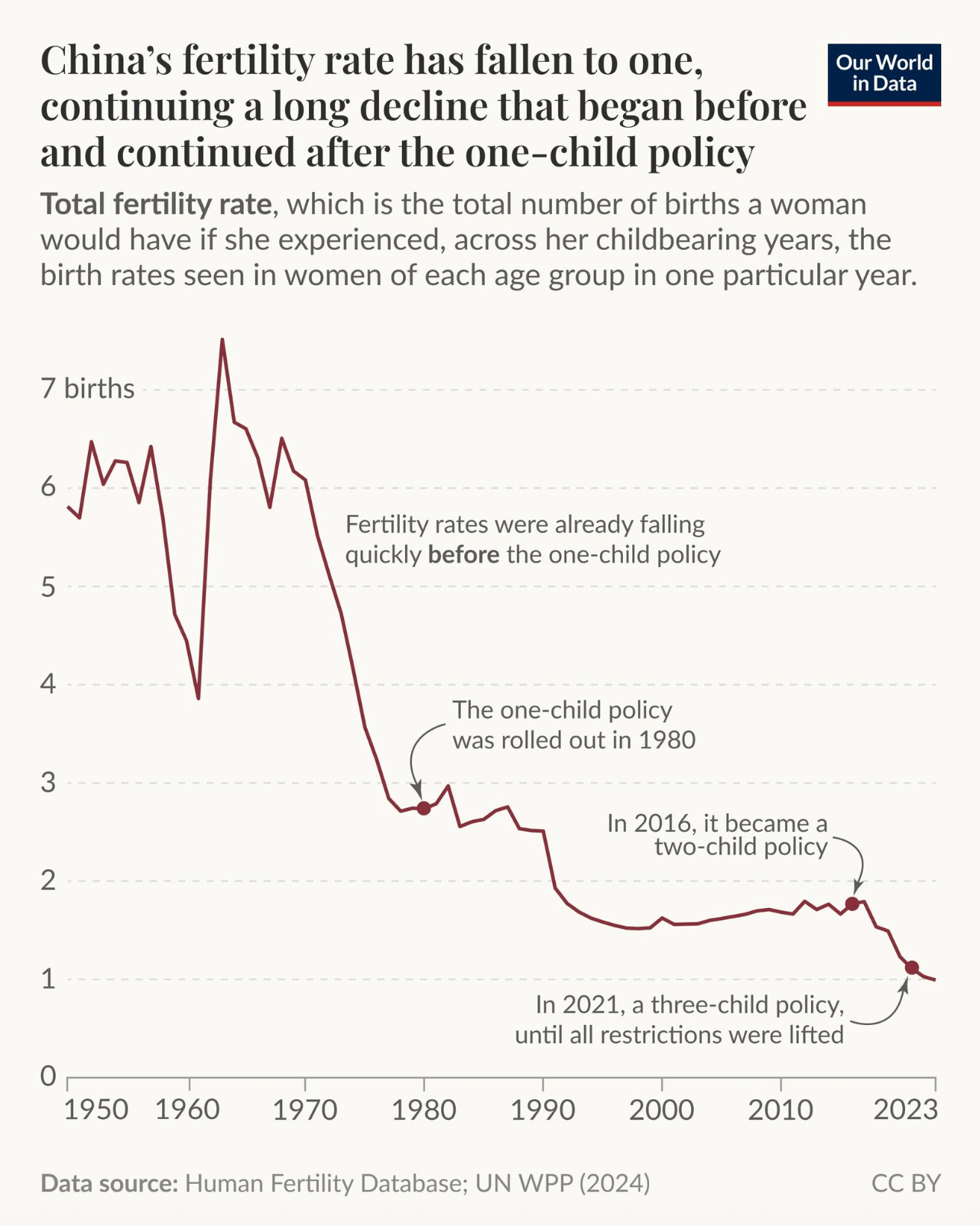

The trend is most profound in East Asia, but it is also true in Europe. Whatever the reasons are, from an investment perspective this is going to drive a massive increase in automation. It is generally presented as a negative, collapsing birth rate = extremely bad. Perhaps though, it is indicative of enormous inbound potential. The remaining Chinese people might become very wealthy.

Reversing a birth rate decline from 1.0 is extremely difficult. The point of no return here is not the total birth rate, more the number of women from 18-35 versus their predecessor cohort. China is producing 45% fewer future mothers than it did 20 years ago. In another 15 years or so, that cohort will halve again. China has passed the point where its net reproduction rate (daughters per woman) could be reversed. Net reproduction rate is different from fertility rate; it measures daughters per woman.

NRR < 1 → population eventually shrinks

NRR < 0.7 → the trap deepens

NRR < 0.5 → irreversible without immigration

China’s estimated NRR in 2023: 0.46–0.50. Irreversible.

I would write “if this is true” but it is likely more than true. The official figures on the Chinese population may not be all they seem. They do have a habit of adding a bit of GST in Beijing so things might in fact be worse. In this analysis the implication seems to be that the TFR fell below one quite some time ago and may now be under 0.9. That would put the NRR well below the reversible range.

The longer term investment themes here are quite obvious. Automation, robotics, hard assets (because debt burdens are unsustainable). India, Philippines, Indonesia & Vietnam would seem to be the natural successors.

As for Australia, it won’t be that good to have our largest trading partner halve in size. When it comes to iron ore though, Indonesia is only 320km away (shortest point to point). Brazil is 15,000km away, the marginal cost advantage will remain with Australia.

If it happens, it will be luck and not good judgement.

Vanke

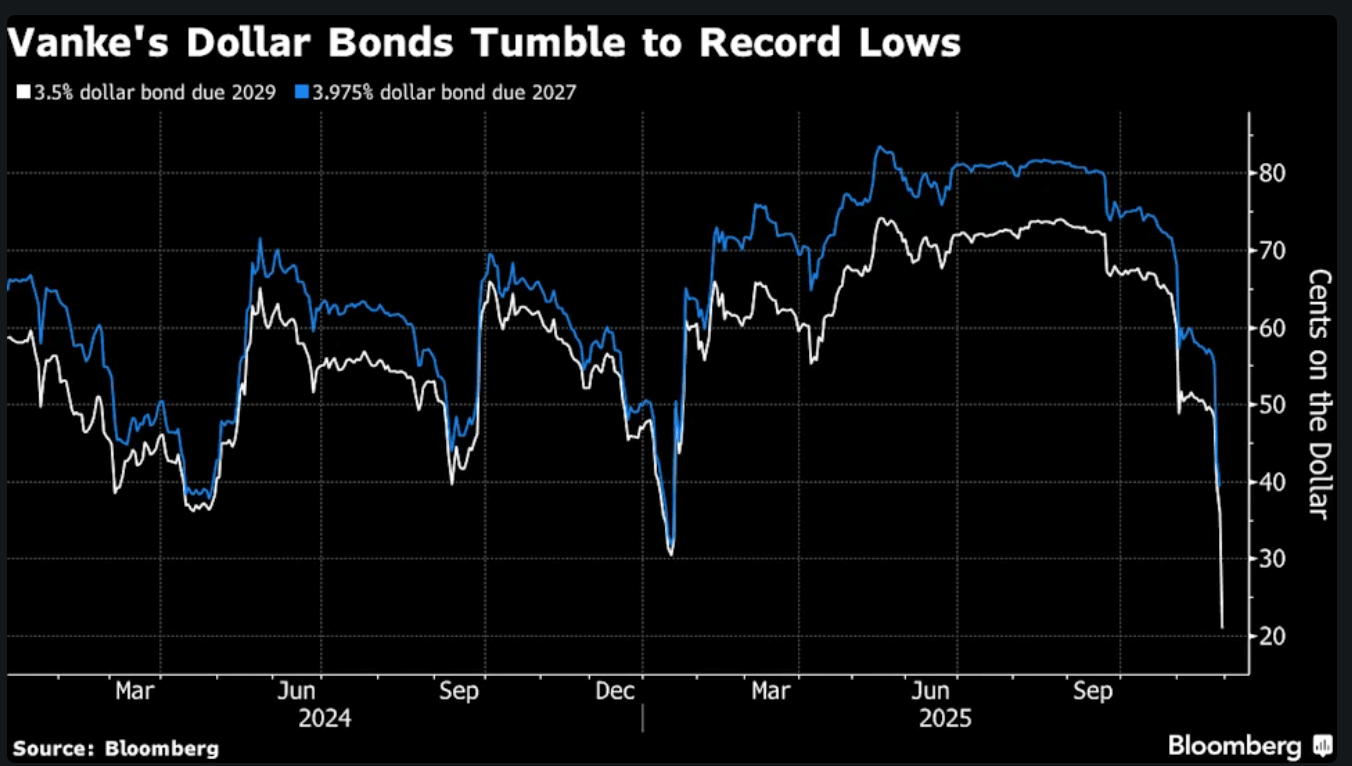

Given those population dynamics, it is not entirely surprising then to see this kind of thing in China. Vanke, once the largest property developer in China, has seen its bonds collapse this week to 30 cents on the dollar.

No doubt there will be some sort of bailout here but Vanke is big and if they fall over they will take a few others with them. They are the last of the major Chinese developers to fall over. Country Garden and Evergrande defaulted long ago and estimates put eventual recoveries in the range of 25 cents to single cents on the dollar.

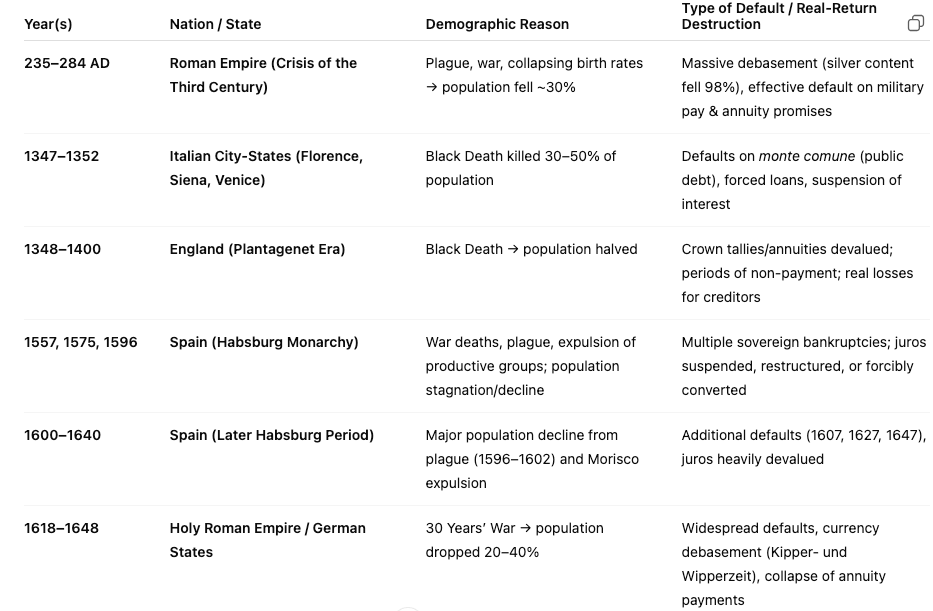

Back to our demographic theme, bonds are terrible investments in falling population environments simply because there aren’t enough people in the end to pay the interest and certainly not the principal. Arguably, this is not what has happened here but it may just be the case that they built a load of apartments and there just aren’t the people to buy them.

I wonder if this is the reason that population issues are not much discussed by the government. It doesn’t take that much googling to find out the net result of a collapsing population.

The Raven of Zurich

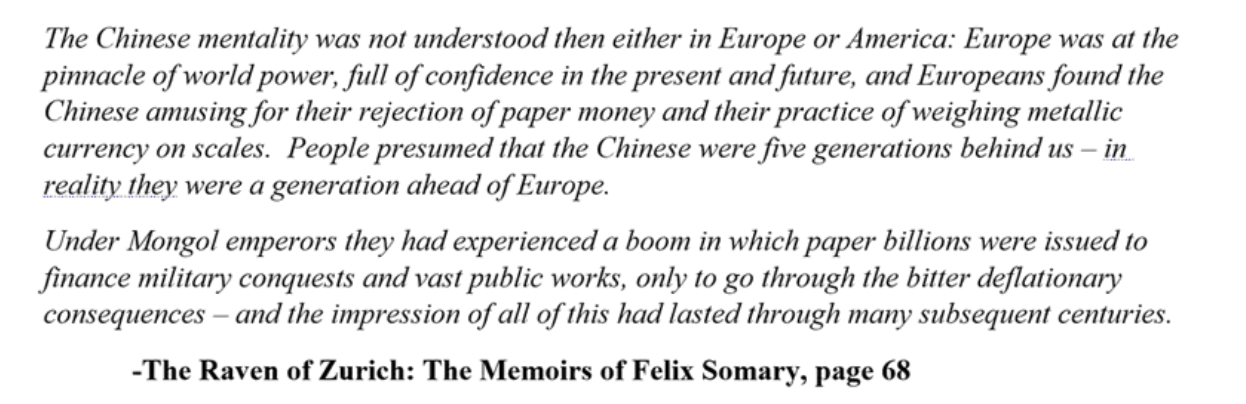

Suffice to say, the destiny of fiat currency was written a long time ago.

Euro-Trash

Europe's leading AI company (there is one, Mistral) released their latest models this week. Their “State of the Art Model”, Mistral 3.0 is both enormous and not very good. It is 5th in the table of open-weight models and nowhere near the top American versions.

The thing with these models is users just default to the best one, or maybe the second best one. Nobody is going to change behaviours to downgrade to the 55th best model because it happens to be European. It is also 3x as expensive to use as DeepSeek, a superior model.

For the purposes of this section of MoneyBits I follow a lot of European accounts. Perhaps for that reason my feed is now full of pro-European propaganda. New accounts which the EU must have launched earlier this year. They are all less than 12 months old, have implausibly enormous followings and all love European tech.

It was non-stop overload this week about how wonderful the new Mistral model is.

But Mistral is not close to the top Chinese models. Kimi-K2 is an outstanding model which is genuinely close to OpenAI and Google, Mistral is nowhere near. Not close.

The issue appears to be that the cost of training large models is enormous. Google, Facebook, AWS, the Chinese state actually have the money to do it. Google’s cash balance is $95 billion. Considering that significant European countries like Belgium only collect $200 billion a year in tax in total, it's not a huge surprise that Europe doesn’t really have the cash to compete. They could, in theory, collate funds across the EU and do it but then who owns the IP? There would be a never ending squabble about the division of spoils and it just wouldn’t work.

Compare that to Google. The driving force and major shareholder Sergey Brin has said he is willing to bet the entire company on AI. One person can decide, not the committee approach of the European Union. Same at Meta, Zuckerberg is losing badly because the Llama models are no good, but he can bet the house on it without really worrying too much. He can summon $50 billion or $100 billion if he needs to, but Mistral just raised $1.7 billion to great fanfare which isn’t going to get them anywhere.

We are almost at the point where it has become a nation state game. The top AI models are transformational for nations in terms of defence, health, education and R&D. You can see why governments might want to get involved. It seems even more obvious when deeply underwhelming models are released along with coordinated, state funded, propaganda campaigns. It’s quite the era we are entering.

Further Information

Our November 2025 report to investors can be found here.