- MoneyBits

- Posts

- Let me explain

Let me explain

EUR fine

📚️ PDF⏳️ 6 min 📖 7

The Quantum Problem

Does Bitcoin have a quantum problem? The answer here is, yes. Specifically, some of the encryption on which bitcoin relies, notably ECDSA, is vulnerable to quantum computers. In reality the most exposed coins are those very old Satoshi coins (about 8% of the total supply), and those coins where people have reused addresses and exposed their public key in the process. The overwhelming majority of coins are not in fact at risk because they have never exposed a public key.

The particularity here is that a quantum computer can in theory do calculations classical computers cannot. The question is, how would we ever know the answer is right if we cannot check? Cryptography is the answer to that question. We do know the answer (the public key), we just can’t go back in the other direction from answer to question (private key) - that's what cryptography is. A quantum computer can, and in so doing it will prove it has powers classical computers do not. Actually a very exciting technology then.

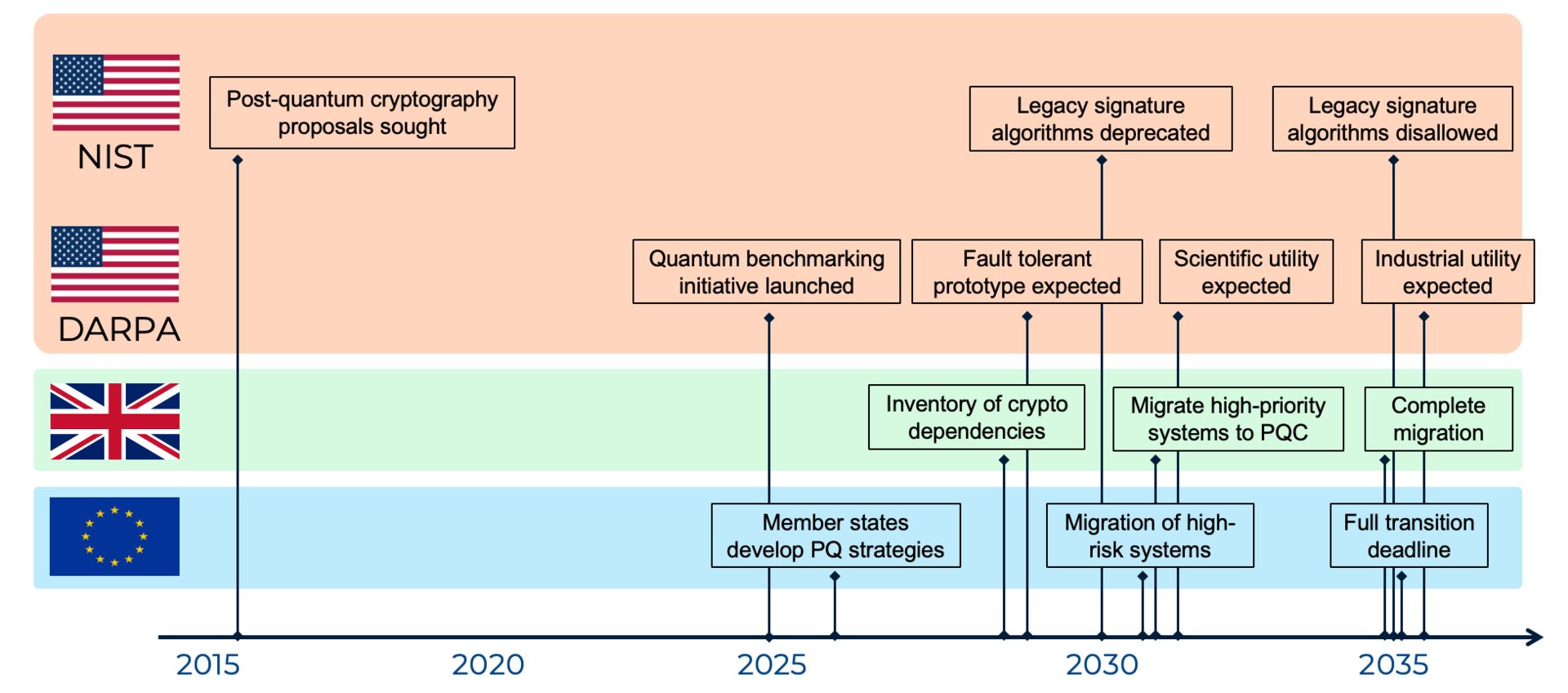

More broadly the quantum issue is not just a bitcoin issue. Every financial institution in the world is vulnerable here. All our passwords, our access to websites and banking, they are all exposed because they all use encryption to protect access. This issue is known by major governments around the world who are moving to post quantum cryptography by 2035 in most cases. There are a lot of different estimates about when cryptographically relevant quantum computers will be available. Some believe by 2030 (often private companies raising money) but the history of quantum computing is that it is hard and takes longer than expected. After all, we have been promised fusion power since 1940 and never got it.

Bitcoin’s advantage is that the developers understand cryptography. The risk to bitcoin is very well and very specifically understood (although the timeline is not). A bitcoin improvement proposal is already underway. BIP360 written by the predictably pseudonymous ‘Hunter Beast’ proposes an upgrade to bitcoin which will provide quantum proof hashes. There will be several steps along the way to the upgrade but it is certain that work is underway to do it. I would guess there are 10 years (and probably more) to get this right.

Almost no other industry other than defence departments are actively working on this issue. After all, bitcoin is an adversarial system. Trust nobody. It does not surprise me at all that DARPA, ASIO, GCHQ and Bitcoin Developers are all working on the same thing. Meanwhile the banking industry is still trying to stop their app going down on a Saturday morning.

I read that quantum computers are going to kill bitcoin. They aren’t. They will expose the Satoshi coins, that is certain. But they are no more relevant than the Mount Gox distributions we experienced this year. The issue of quantum computing is much wider and we should be glad everyone looks to bitcoin first.

Therefore, send not to know

For whom the bell tolls,

It tolls for thee

Let me explain

You’d have to say that on the trend of inflation alone, a cut in US interest rates wasn’t really warranted. Trueflation reports 2.7%, the government itself reports higher 3%. It’s a gigantic proportion over the supposed 2% target.

The value of money halves in 35 years at 2%. More than a generation, a smart choice really because you don’t notice. At 3% it's 23 years and at 5%, a mere 14 years. That seems closer to today's experience.

Given the inflation backdrop then, the Fed's sense on employment data must be strongly negative and perhaps that explains the other and far more surprising thing they did last week. The announcement that they will be buying $20 billion in T-Bills every month.

The Chairman waved away any suggestion of QE explaining as follows:

“Reserve Management Purchases (RMPs) are made to prevent a tightening of short-term liquidity ahead of the April 15 tax payments.”

The idea being that everyone withdraws money from banks in April to pay the government. So we need to get ready and make sure banks have the money to give to the people, to give to the government so they can give it back to different people.

It might be true. But, wouldn’t it always be true every April?

It’s quantitative easing-lite. It will make the journey to actual QE less stark. Unsurprisingly, I expect that to happen sometime after April which happily coincides with the end of Jerome Powell’s term as Fed Chair.

Probably unrelated, right?

A new ETF

In 2018 I was invited to a dinner in Sydney to discuss bitcoin. Hosting was Olaf Carlson-Wee who was Coinbase’s first ever employee. He brought with him a slew of American bankers and finance experts, one of whom spent most of the dinner explaining to me why there would ‘never be a Bitcoin ETF’. There were in fact a lot of reasons at the time, recall the Winklevoss brothers first applied (and were rejected) in 2013. His main reason was that “the SEC at the time ‘just hates it’ ... .there is no way, it's just not going to happen”.

As we know, it did in fact happen and now there are many ETFs with little separating them other than brand, until now. Nicholas Financial has filed for an ‘After Dark’ Bitcoin ETF. They will sell their bitcoin just before the US market opens and buy it after the close. The reason being that most bitcoin gains (historically) have occurred outside normal trading hours.

The full application document is here. Arguably, it's a little bit gimmicky but it may in fact find an edge. All the other bitcoin ETFs need to buy and sell at the same time as a result of US market trading hours. Selling when others are selling and buying when they are buying is always going to be a bit more expensive.

It reminds me rather of pre-financial crisis Goldman Sachs. Prior to 2008 they had a November year compared to almost all other banks which had a traditional December close. The rationale was they could take advantage of December when other banks need to buy and sell things to tidy up their balance sheets.

All banks do the same things in December because they have to disclose what they own. Ditch the riskiest assets, buy the safer ones. That kind of thing. Goldman happily mopped them up. This ETF might be a gimmick, but it might just outperform all the others.

Incidentally, Goldman was bailed out in 2008 and forced to convert to a bank holding company. They also were required to move to a December year end, like everyone else. Unsurprisingly, they started to perform like everyone else from that point onward. The aura was gone, they were different and suddenly they weren’t.

OK to buy

The OCC doesn’t write many letters. Back in March this year they wrote to US banks (letter 1183) about what was permissible as far as cryptocurrency was concerned. Now they have written again, “you can buy and sell bitcoin for your clients”.

Hardly earth shattering but they make their decisions slowly and rarely change them so we’ll take it.

Last one for the year

That is it for 2025 MoneyBits. The big winner this year was not bitcoin, it was Christine Lagarde.

Lamfalussy Award in January (‘honoured’)

Sutherland Leadership Award in April (‘delighted’)

Global Leadership Award in July (‘honoured’ again)

Strong 2025 from Christine. A year in which the European economy went backwards. They managed to destroy their already tiny AI industry and the only time they met the 2% inflation target were the months when they were all on holiday.

Time for one more Euro-Trash then, obviously.

Euro-Trash

The Elon-EU spat kicked into overdrive recently when they fined him for €120 million for “deceptive blue ticks”. You get a blue tick if you pay some money and fill in a form.

The European Union’s argument is that the level of verification is “too minimal”. A blue tick gives the impression that the person may be who they say they are and so the European public might be misled or defrauded. So, that will be €120 million, please.

There is some truth in the fact that the blue ticks are not perhaps as robust as they once were. You had to qualify for them and couldn’t just buy them. So maybe they have a point.

There was more to the fine though than the blue ticks. X was accused of failing to hand over data to “researchers”. Those “researchers” are basically the new Euro-Stasi who hunt down Europeans unfortunate enough to have said something unpopular on social media. You know, like ‘maybe windmills are technology from 1600?’ or ‘I can’t take the lid off my water bottle’. When that happens Euro-Stasi demands information like IP addresses and emails so they can track down the user and send them to a re-education camp at Davos.

Failure to provide researchers access to public data

X fails to meet its DSA obligations to provide researchers with access to the platform's public data. For instance, X's terms of service prohibit eligible researchers from independently accessing its public data, including through scraping. Moreover, X's processes for researchers' access to public data impose unnecessary barriers, effectively undermining research into several systemic risks in the European Union.

The fine issued today was calculated taking into account the nature of these infringements, their gravity in terms of affected EU users, and their duration.

All told though it’s good business. The EU made more from fining US tech companies in 2024 than their entire tech-sector paid in tax. Unlikely to be sustainable and life will get quite interesting quite quickly if the US tech titans simply reach for the off button. One day Europe’s economy will be small enough to be a rounding difference so don’t discount the possibility.

Further Information

Our November 2025 report to investors can be found here.